The Spheria Global Opportunities Fund returned –1.9% for the month of June, outperforming the MSCI World Small Cap index by 0.4% (net of fees). During the quarter to June, the Fund returned –2.4% (net of fees), materially outperforming the benchmark by 2.4%.

Performance

1 Spheria Global Opportunities Fund. Returns of the Fund are net of applicable fees, costs and taxes.

2 Benchmark is MSCI World Small Cap Index (net in AUD) for all periods. Please note that the Benchmark from inception to 30 June 2021 was the MSCI Kokusai Microcap Index (net in AUD) and from 1 July 2021 to 30 September 2022 was the MSCI World Microcap Index (net in AUD).

3 Inception date is 1 March 2019. Past performance is not a reliable indicator of future performance. All p.a. returns are annualised.

Please note the strategy of the Fund changed effective 1 October 2022. The Spheria Global Opportunities Fund was previously known as the Spheria Global Microcap Fund which targeted global listed microcap companies (companies with a market capitalisation of US$1 billion and below at time of purchase).

Overall Commentary

Top 5 Holdings

Regional Exposure

Source: Spheria Asset Management

Sector Exposure

Markets

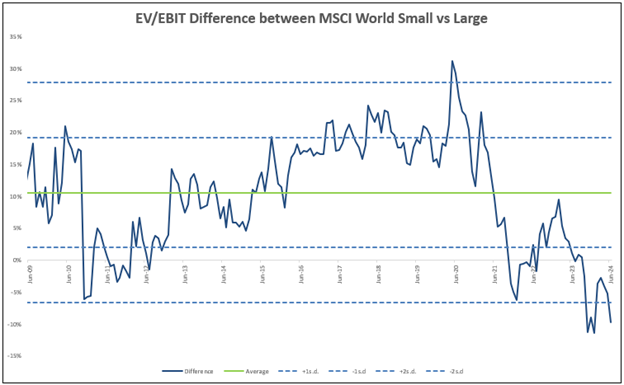

Whilst the broader market rallies to all-time highs driven by the so-called “Magnificent 7”, we continue to see a valuation disconnect as the gap between large and small caps continues to widen. The MSCI World Small Cap index retraced -5% in the quarter after having risen 25% from the October 2023 lows. Valuations for larger companies are looking increasingly expensive in a historical context. Whilst valuations can stay rich for a long time, we note with interest that the disparity between small and large cap earnings multiples is greater than 2 standard deviations below the long-term average.

Evidence of cyclical weakness isn’t difficult to find at present which is unsurprising after roughly 500bps of interest rate tightening in the space of two years. US bankruptcy filings are continuing to climb and currently sit at their highest levels since the GFC. China’s recovery remains tough and now appears likely to be more drawn out than many had anticipated. Meanwhile, ongoing tensions in the Middle East have seen a resurgence in freight rates at a time when both consumers and central banks can least afford it. Reflecting the difficult macro backdrop, we saw weakness in the Consumer Discretionary & Industrials sectors during the quarter, whilst regionally EMEA and APAC also underperformed.

On the other side of the same coin we note with interest that Canada, the ECB (Eurozone), Switzerland and Sweden all cut interest rates during June by 25bps. Several other major countries, namely the US, UK and Australia all held rates over the month with the US Fed providing its strongest hint yet that rates could come down later in the year.

If prior cycles are any guide, a peak in the rate cycle will precede a period of outperformance of small caps over large.

Major contributors to performance

Over the quarter the largest contributors to performance were from overweight positions in Hargreaves Lansdown (HL.LN, +50%), Napco Securities (NSSC.US, +27%), and Computer Modelling Group (CMG.CN, +26%).

Hargreaves Lansdown (HL.LN) – During the quarter, Hargreaves Lansdown received an indicative non-binding takeover bid at 40% premium by a consortium led by private equity. This was the consortium’s 4th bid, with the HL board finally agreeing to engage and support the bid if it becomes final.

HL’s strong market position as the UK’s largest consumer-based wealth platform and strong cashflow generation, combined with a period of underperformance, unsurprisingly (from our perspective) made it a target for private equity. The business continues to generate positive inflows and revenue is also benefiting from strong market performance.

HL is upgrading its tech platform, which will improve its efficiency, scalability and product offering to the market. If successful, this would cement Hargreaves as the leading consumer-based wealth platform in the UK. The takeover price values Hargreaves at 12x FY25 EV/EBIT, which we view as attractive given the upgrade cycle it is currently undergoing.

Computer Modelling Group (CMG.CN) – CMG is a Canadian-based software provider, specialising in reservoir simulation software for oil and gas companies. The business is executing on its explicit acquisition strategy and growing organically as the market’s need for complex, unconventional oil and gas recovery techniques continues to grow.

CMG announced its full year earnings in May, with a positive reception to its successful integration of Bluware, an acquisition which expands its presence into upstream seismic data interpretation. Full year organic growth for the core business was a strong +15%, and the revenue contribution from energy transition (e.g. Carbon capture and storage) continues to grow and now represents 24% of group revenue, up from 14% a year earlier. To this end, we note that CMG has the somewhat unique attribute of being able to clip the proverbial ticket twice as efforts to both maximise oil and gas production and mitigate its associate carbon emissions increase.

After exceptionally strong recent performance, CMG can no longer be considered cheap. But management is executing well, the company has a net cash balance sheet, and ~100% free cash flow conversion. It also diversifies the portfolio providing an exposure to the energy sector whilst avoiding the more direct exposures in the benchmark that tend to be lower quality, higher cost, cash burning explorers.

Major detractors from performance

Over the month the largest detractors to performance were from overweight positions in YouGov (YOU.LN, -60%), LKQ Corp (LKQ.US, -23%) and AGCO (ACGO.US, -20%).

YouGov (YOU.LN) – YouGov provided a disappointing trading update ahead of their full year results in July, which implied a decline in organic revenue in the 2H versus the prior corresponding period, and subsequent operational deleverage. The slowdown, particularly in the DACH region, appears to be localised in the Data Product Segments, which has been a consistent source of earnings growth in the past.

YouGov has experienced a volatile 18 months, during which the macro backdrop has weakened, competitive pressures have intensified, and it completed the sizeable acquisition of GfK’s Consumer Panel Business (Jan-23).

The current global election cycle is a great advertisement for YouGov’s products, given its status as one of the major polling providers globally. It should be able to leverage this opportunity to increase its brand awareness and ultimately drive organic revenue growth.

The company now trades on 17x FY24 EBIT, with margins near cyclical lows. The balance sheet is geared at 2.5x ND/EBITDA. The business remains highly cash generative which will facilitate the rapid amortization of the debt.

AGCO (AGCO.US) – Global agriculture equipment names have been under pressure as soft commodity prices retraced from their pandemic peaks, impacting farmer incomes and thus order volumes for tractors and the farm equipment in which manufacturers such as AGCO specialise. Soft commodity prices have broadly tracked global energy prices, peaking during 2022 on reduced supply from Russia/Ukraine and a rebound in demand after Covid-19.

AGCO management expects the cycle to remain weak for 1-2yrs, whilst its larger competitor Deere notes that the typical cycle is 2yrs, but a higher tractor age vs history and still healthy farmer profitability (albeit below peak) could mean a shorter more muted downturn this time. In response, AGCO announced a 6% reduction in headcount earlier this month.

AGCO trades on a relatively modest 8.5x FY24 EBIT. So whilst the near-term earnings outlook is admittedly clouded, we take some comfort from an already depressed multiple and the improved quality of the business vs history (more higher margin Fendt tractor sales, more parts, and more Precision Ag).

Outlook & Strategy Going Forward

Overall we feel backward-looking statistics aren’t fully reflecting the toughening labour market nor capturing a toughening consumer sentiment. Central Banker’s should begin to see an opportunity to reduce rates if economies continue to get more challenging as we expect. Better management teams should be able to drive better outcomes for shareholders as they navigate through the challenging environment. In the global arena the opportunity for small caps vs. large caps hasn’t been this attractive for some time which gives us some reason for optimism. We believe businesses with strong balance sheets and a proven ability to generate cash are likely to come through market challenges in better shape and we continue to focus on unearthing these types of opportunities.

Platform Availability List

The Spheria Global Opportunities Fund is available on the below Platforms. Please check with your platform for minimum investment requirements and fees.

Asgard

BT Panorama

HUB24

Macquarie Wrap

Netwealth

Praemium

| Spheria Global Opportunities Fund | value |

|---|---|

| Benchmark | MSCI World Small Cap Index |

| Investment Objective | Outperform the MSCI World Small Cap Index in AUD (Net) over the long term |

| Investing Universe | Global listed small cap and microcap companies with a market capitalisation equal to or lower than the market capitalisation of the largest issuer in the MSCI Global Small Cap Index at the time of purchase |

| Holdings | Generally 30-80 stocks |

| Distributions | Annually |

| Fees | 1.10% p.a. management fee & 20% performance fee of the Fund’s excess return versus its benchmark, net of the management fee |

| Cash | Up to 20% cash |

| Expected Turnover | 20% - 40% |

| Style | Long only |

| APIR | WHT6704AU |

| Minimum Initial Investment | $25,000 |

Fund Ratings

Further Information

For more information, please contact Pinnacle Investment Management Limited

on 1300 010 311 or email distribution@pinnacleinvestment.com

Disclaimer

This communication is prepared by Spheria Asset Management Pty Limited (‘Spheria’) (ABN 42 611 081 326, Corporate Authorised Representative No. 1240979) as the investment manager of the Spheria Global Microcap Fund (ARSN 627 330 287) (the ‘Fund’). Pinnacle Fund Services Limited (‘PFSL’) (ABN 29 082 494 362, AFSL 238371) is the product issuer of the Funds. PFSL is not licensed to provide financial product advice. PFSL is a wholly-owned subsidiary of the Pinnacle Investment Management Group Limited (‘Pinnacle’) (ABN 22 100 325 184). The Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) of the Fund are available via the links below. Any potential investor should consider the PDS and TMD before deciding whether to acquire, or continue to hold units in, the Fund.

Link to the Product Disclosure Statement

Link to the Target Market Determination

For historic TMD’s please contact Pinnacle client service Phone 1300 010 311 or Email service@pinnacleinvestment.com

This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so. Past performance is for illustrative purposes only and is not indicative of future performance. Unless otherwise specified, all amounts are in Australian Dollars (AUD).

Whilst Spheria, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Spheria, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. This disclaimer extends to any entity that may distribute this communication.

Any opinions and forecasts reflect the judgment and assumptions of Spheria and its representatives on the basis of information available as at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Spheria. Pinnacle and its associates may have interests in financial products and may receive fees from companies referred to during this communication.

This may contain the trade names or trademarks of various third parties, and if so, any such use is solely for illustrative purposes only. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with, endorsement by, or association of any kind between them and Spheria.

Zenith Disclaimer: The Zenith Investment Partners (‘Zenith’) (ABN 27 103 132 672, AFSL 226872) rating (assigned Spheria Global Opportunities Fund – November 2022) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at Fund Research Regulatory Guidelines.

Lonsec Disclaimer: The Lonsec rating (assigned as follows: Spheria Global Opportunities Fund – March 2023) presented in this document is published by Lonsec Research Pty Ltd (‘Lonsec’) (ABN 11 151 658 561, AFSL 421445). The Rating is limited to “General Advice” (as defined in the Corporations Act 2001 (Cth)) and based solely on consideration of the investment merits of the financial products. Past performance information is for illustrative purposes only and is not indicative of future performance. They are not a recommendation to purchase, sell or hold Affiliate Name products, and you should seek independent financial advice before investing in these products. The Ratings are subject to change without notice and Lonsec assumes no obligation to update the relevant documents following publication. Lonsec receives a fee from the Fund Manager for researching the products using comprehensive and objective criteria. For further information regarding Lonsec’s Ratings methodology, please refer to our website at: https://www.lonsec.com.au/investment-product-ratings/.