In March 2019, Spheria Asset Management launched the Spheria Global Opportunities Fund, confident this largely unexplored segment of the market presented the greatest opportunity for client wealth creation. The Fund is a carefully constructed portfolio of solid businesses, with strong cash flow generation and good balance sheets.

Spheria Global Opportunities Fund

Overview

About the Fund

Existing Unitholders: Please note the Spheria Global Opportunities Fund changed name from the Spheria Global Microcap Fund on 1 October 2022. Read more

Investment Managers

Marcus Burns

Co-Portfolio Manager

Matthew Booker

Co-Portfolio Manager

Adam Lund

Head of Trading / Analyst

Daniel Peters

Head of Research

Charles Ji

Analyst

Al Doecke

Trader

Damian Rawle

Data Analyst

Isabella Tu

Analyst

Ratings

The Spheria Global Opportunities Fund received an ‘Approved’ rating from Zenith Investment Partners (November 2022)1 and an ‘Investment Grade’ rating from Lonsec Research (March 2023)2. Further information on our Ratings and Certifications can be found in the Disclaimer & Disclosure section.

Fund Facts

| Spheria Global Opportunities Fund | value |

|---|---|

| Benchmark | MSCI World Small Cap Index |

| Investment Objective | Outperform the MSCI World Small Cap Index in AUD (Net) over the long term |

| Suggested Minimum Investment Timeframe | 7 years |

| Investing Universe | Predominantly investing in globally listed smaller companies with a market capitalisation of US$20bn and below at time of purchase. |

| Suitable Investor Profile | This product is intended for use as a core, minor or satellite allocation for a consumer who is seeking capital growth and has a high or very high risk and return profile for that portion of their investment portfolio. It is likely to be consistent with the financial situation and needs of a consumer with a 7-year investment timeframe and who is unlikely to need to withdraw their money on less than one week’s notice. |

| Risk | High |

| Holdings | Generally 30-80 stocks |

| Distributions | Annually |

| Fees | 1.10% p.a. management fee & 20% performance fee of the Fund’s excess return versus its benchmark, net of the management fee. |

| Portfolio Allocation1 |

80-100% Global equities 0-20% Cash and cash equivalents |

| Expected Turnover | 20% - 40% |

| Style | Long only |

| APIR | WHT6704AU |

| Minimum Initial Investment | $25,000 |

Benchmark from inception until 30th June 2021 was the MSCI Kokusai (World Ex-Japan) Microcap Index. Thereafter from 1 July 2021, the Benchmark is the MSCI World Microcap Index. Thereafter from 1 October 2022, the new Benchmark is the MSCI World Small Cap Index.

1 The portfolio allocation ranges provided are indicative only. The Fund will be rebalanced within a reasonable period of time should the exposure move outside these ranges.

Why Global Small & Micro Caps?

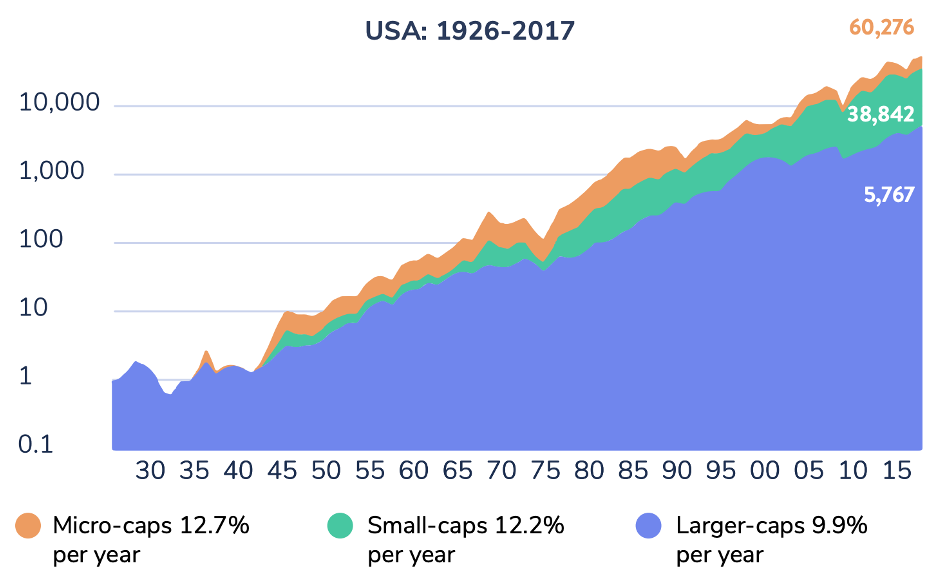

Over the long-run, small caps and micro caps have been the best performing segment in the USA and UK. These strong returns reflect the stock opportunities available within this investment universe of undiscovered, emerging companies.

Small Caps & Micro Caps vs. Large Caps: Long-Run Cumulative Performance of Stocks in Different Size Bands

Source: Credit Suisse

Performance

| As at 30 September 2024 | 1 Month | 3 Months | 1 Year | 3 Years p.a. | 5 Years p.a. | Inception p.a³ |

|---|---|---|---|---|---|---|

| Fund¹ | -0.4 | 4.3 | 15.7 | 2.3 | 12.2 | 11.7 |

| Benchmark² | -0.4 | 5.3 | 16.2 | 3.6 | 8.4 | 8.4 |

| Difference | -0.1 | -1.0 | -0.5 | -1.2 | 3.8 | 3.3 |

1 Spheria Global Opportunities Fund. Returns of the Fund are net of applicable fees, costs and taxes.

2 Benchmark is MSCI World Small Cap Index (net in AUD) for all periods. Please note that the Benchmark from inception to 30 June 2021 was the MSCI Kokusai Microcap Index (net in AUD) and from 1 July 2021 to 30 September 2022 was the MSCI World Microcap Index (net in AUD).

3 Inception date is 1 March 2019. Past performance is not a reliable indicator of future performance. All p.a. returns are annualised.

Please note the strategy of the Fund changed effective 1 October 2022. The Spheria Global Opportunities Fund was previously known as the Spheria Global Microcap Fund which targeted global listed microcap companies (companies with a market capitalisation of US$1 billion and below at time of purchase).

Unit Prices and Distributions

Unit Price History

| Date | Net Entry Price | NAV | Net Exit Price |

|---|---|---|---|

| 2024-10-22 | 1.5035 | 1.4990 | 1.4945 |

| 2024-10-21 | 1.5211 | 1.5166 | 1.5121 |

| 2024-10-18 | 1.5242 | 1.5196 | 1.515 |

| 2024-10-17 | 1.5206 | 1.5161 | 1.5116 |

| 2024-10-16 | 1.5306 | 1.5260 | 1.5214 |

| 2024-10-15 | 1.521 | 1.5165 | 1.512 |

| 2024-10-14 | 1.5128 | 1.5083 | 1.5038 |

| 2024-10-11 | 1.5101 | 1.5056 | 1.5011 |

| 2024-10-10 | 1.5054 | 1.5009 | 1.4964 |

| 2024-10-09 | 1.5149 | 1.5104 | 1.5059 |

| 2024-10-08 | 1.5053 | 1.5008 | 1.4963 |

| 2024-10-04 | 1.4978 | 1.4933 | 1.4888 |

| 2024-10-03 | 1.4844 | 1.4800 | 1.4756 |

| 2024-10-02 | 1.4813 | 1.4769 | 1.4725 |

| 2024-10-01 | 1.4921 | 1.4876 | 1.4831 |

| 2024-09-30 | 1.4943 | 1.4898 | 1.4853 |

| 2024-09-27 | 1.5056 | 1.5011 | 1.4966 |

| 2024-09-26 | 1.5025 | 1.4980 | 1.4935 |

| 2024-09-25 | 1.4922 | 1.4877 | 1.4832 |

| 2024-09-24 | 1.4958 | 1.4913 | 1.4868 |

| 2024-09-23 | 1.4893 | 1.4848 | 1.4803 |

| 2024-09-20 | 1.4905 | 1.4860 | 1.4815 |

| 2024-09-19 | 1.5077 | 1.5032 | 1.4987 |

| 2024-09-18 | 1.4944 | 1.4899 | 1.4854 |

| 2024-09-17 | 1.4949 | 1.4904 | 1.4859 |

| 2024-09-16 | 1.4924 | 1.4879 | 1.4834 |

| 2024-09-13 | 1.4934 | 1.4889 | 1.4844 |

| 2024-09-12 | 1.4824 | 1.4780 | 1.4736 |

| 2024-09-11 | 1.4802 | 1.4758 | 1.4714 |

| 2024-09-10 | 1.4808 | 1.4764 | 1.472 |

| 2024-09-09 | 1.4793 | 1.4749 | 1.4705 |

| 2024-09-06 | 1.4672 | 1.4628 | 1.4584 |

| 2024-09-05 | 1.4732 | 1.4688 | 1.4644 |

| 2024-09-04 | 1.4859 | 1.4815 | 1.4771 |

| 2024-09-03 | 1.4943 | 1.4898 | 1.4853 |

| 2024-09-02 | 1.4907 | 1.4862 | 1.4817 |

| 2024-08-30 | 1.5007 | 1.4962 | 1.4917 |

| 2024-08-29 | 1.4892 | 1.4847 | 1.4802 |

| 2024-08-28 | 1.4901 | 1.4856 | 1.4811 |

| 2024-08-27 | 1.4957 | 1.4912 | 1.4867 |

| 2024-08-26 | 1.4937 | 1.4892 | 1.4847 |

| 2024-08-23 | 1.4998 | 1.4953 | 1.4908 |

| 2024-08-22 | 1.4968 | 1.4923 | 1.4878 |

| 2024-08-21 | 1.4957 | 1.4912 | 1.4867 |

| 2024-08-20 | 1.4861 | 1.4817 | 1.4773 |

| 2024-08-19 | 1.4965 | 1.4920 | 1.4875 |

| 2024-08-16 | 1.5028 | 1.4983 | 1.4938 |

| 2024-08-15 | 1.4977 | 1.4932 | 1.4887 |

| 2024-08-14 | 1.4902 | 1.4857 | 1.4812 |

| 2024-08-13 | 1.4841 | 1.4797 | 1.4753 |

| 2024-08-12 | 1.4696 | 1.4652 | 1.4608 |

| 2024-08-09 | 1.4813 | 1.4769 | 1.4725 |

| 2024-08-08 | 1.4681 | 1.4637 | 1.4593 |

| 2024-08-07 | 1.4589 | 1.4545 | 1.4501 |

| 2024-08-06 | 1.4724 | 1.4680 | 1.4636 |

| 2024-08-05 | 1.4632 | 1.4588 | 1.4544 |

| 2024-08-02 | 1.4986 | 1.4941 | 1.4896 |

| 2024-08-01 | 1.5278 | 1.5232 | 1.5186 |

| 2024-07-31 | 1.5506 | 1.5460 | 1.5414 |

| 2024-07-30 | 1.5344 | 1.5298 | 1.5252 |

| 2024-07-29 | 1.5321 | 1.5275 | 1.5229 |

| 2024-07-26 | 1.5333 | 1.5287 | 1.5241 |

| 2024-07-25 | 1.5211 | 1.5166 | 1.5121 |

| 2024-07-24 | 1.5089 | 1.5044 | 1.4999 |

| 2024-07-23 | 1.5198 | 1.5153 | 1.5108 |

| 2024-07-22 | 1.5106 | 1.5061 | 1.5016 |

| 2024-07-19 | 1.4886 | 1.4841 | 1.4796 |

| 2024-07-18 | 1.4953 | 1.4908 | 1.4863 |

| 2024-07-17 | 1.4964 | 1.4919 | 1.4874 |

| 2024-07-16 | 1.4904 | 1.4859 | 1.4814 |

| 2024-07-15 | 1.4728 | 1.4684 | 1.464 |

| 2024-07-12 | 1.4723 | 1.4679 | 1.4635 |

| 2024-07-11 | 1.4603 | 1.4559 | 1.4515 |

| 2024-07-10 | 1.4372 | 1.4329 | 1.4286 |

| 2024-07-09 | 1.4321 | 1.4278 | 1.4235 |

| 2024-07-08 | 1.436 | 1.4317 | 1.4274 |

| 2024-07-05 | 1.4348 | 1.4305 | 1.4262 |

| 2024-07-04 | 1.4376 | 1.4333 | 1.429 |

| 2024-07-03 | 1.4363 | 1.4320 | 1.4277 |

| 2024-07-02 | 1.4351 | 1.4308 | 1.4265 |

| 2024-07-01 | 1.4327 | 1.4284 | 1.4241 |

| 2024-06-28 | 1.4585 | 1.4541 | 1.4497 |

| 2024-06-27 | 1.465 | 1.4606 | 1.4562 |

| 2024-06-26 | 1.4637 | 1.4593 | 1.4549 |

| 2024-06-25 | 1.4669 | 1.4625 | 1.4581 |

| 2024-06-24 | 1.4713 | 1.4669 | 1.4625 |

| 2024-06-21 | 1.4695 | 1.4651 | 1.4607 |

| 2024-06-20 | 1.4679 | 1.4635 | 1.4591 |

| 2024-06-19 | 1.4747 | 1.4703 | 1.4659 |

| 2024-06-18 | 1.4816 | 1.4772 | 1.4728 |

| 2024-06-17 | 1.475 | 1.4706 | 1.4662 |

| 2024-06-14 | 1.4694 | 1.4650 | 1.4606 |

| 2024-06-13 | 1.4837 | 1.4793 | 1.4749 |

| 2024-06-12 | 1.4876 | 1.4832 | 1.4788 |

| 2024-06-11 | 1.4857 | 1.4813 | 1.4769 |

| 2024-06-07 | 1.4903 | 1.4858 | 1.4813 |

| 2024-06-06 | 1.4838 | 1.4794 | 1.475 |

| 2024-06-05 | 1.4913 | 1.4868 | 1.4823 |

| 2024-06-04 | 1.4791 | 1.4747 | 1.4703 |

| 2024-06-03 | 1.476 | 1.4716 | 1.4672 |

| 2024-05-31 | 1.4869 | 1.4825 | 1.4781 |

| 2024-05-30 | 1.4761 | 1.4717 | 1.4673 |

| 2024-05-29 | 1.472 | 1.4676 | 1.4632 |

| 2024-05-28 | 1.4874 | 1.4830 | 1.4786 |

| 2024-05-27 | 1.495 | 1.4905 | 1.486 |

| 2024-05-24 | 1.4947 | 1.4902 | 1.4857 |

| 2024-05-23 | 1.4892 | 1.4847 | 1.4802 |

| 2024-05-22 | 1.4817 | 1.4773 | 1.4729 |

| 2024-05-21 | 1.4816 | 1.4772 | 1.4728 |

| 2024-05-20 | 1.481 | 1.4766 | 1.4722 |

| 2024-05-17 | 1.4758 | 1.4714 | 1.467 |

| 2024-05-16 | 1.4753 | 1.4709 | 1.4665 |

| 2024-05-15 | 1.4828 | 1.4784 | 1.474 |

| 2024-05-14 | 1.4815 | 1.4771 | 1.4727 |

| 2024-05-13 | 1.4751 | 1.4707 | 1.4663 |

| 2024-05-10 | 1.477 | 1.4726 | 1.4682 |

| 2024-05-09 | 1.4719 | 1.4675 | 1.4631 |

| 2024-05-08 | 1.464 | 1.4596 | 1.4552 |

| 2024-05-07 | 1.4566 | 1.4522 | 1.4478 |

| 2024-05-06 | 1.4494 | 1.4451 | 1.4408 |

| 2024-05-03 | 1.4405 | 1.4362 | 1.4319 |

| 2024-05-02 | 1.4377 | 1.4334 | 1.4291 |

| 2024-05-01 | 1.4385 | 1.4342 | 1.4299 |

| 2024-04-30 | 1.4446 | 1.4403 | 1.436 |

| 2024-04-29 | 1.448 | 1.4437 | 1.4394 |

| 2024-04-26 | 1.4395 | 1.4352 | 1.4309 |

| 2024-04-24 | 1.4514 | 1.4471 | 1.4428 |

| 2024-04-23 | 1.4567 | 1.4523 | 1.4479 |

| 2024-04-22 | 1.4591 | 1.4547 | 1.4503 |

| 2024-04-19 | 1.4545 | 1.4501 | 1.4457 |

| 2024-04-18 | 1.447 | 1.4427 | 1.4384 |

| 2024-04-17 | 1.4511 | 1.4468 | 1.4425 |

| 2024-04-16 | 1.4623 | 1.4579 | 1.4535 |

| 2024-04-15 | 1.4627 | 1.4583 | 1.4539 |

| 2024-04-12 | 1.4664 | 1.4620 | 1.4576 |

| 2024-04-11 | 1.4697 | 1.4653 | 1.4609 |

| 2024-04-10 | 1.4666 | 1.4622 | 1.4578 |

| 2024-04-09 | 1.4604 | 1.4560 | 1.4516 |

| 2024-04-08 | 1.4646 | 1.4602 | 1.4558 |

| 2024-04-05 | 1.4648 | 1.4604 | 1.456 |

| 2024-04-04 | 1.455 | 1.4506 | 1.4462 |

| 2024-04-03 | 1.4734 | 1.4690 | 1.4646 |

| 2024-04-02 | 1.4804 | 1.4760 | 1.4716 |

| 2024-03-28 | 1.4951 | 1.4906 | 1.4861 |

| 2024-03-27 | 1.4992 | 1.4947 | 1.4902 |

| 2024-03-26 | 1.4871 | 1.4827 | 1.4783 |

| 2024-03-25 | 1.4898 | 1.4853 | 1.4808 |

| 2024-03-22 | 1.4957 | 1.4912 | 1.4867 |

| 2024-03-21 | 1.491 | 1.4865 | 1.482 |

| 2024-03-20 | 1.4858 | 1.4814 | 1.477 |

| 2024-03-19 | 1.4819 | 1.4775 | 1.4731 |

| 2024-03-18 | 1.4696 | 1.4652 | 1.4608 |

| 2024-03-15 | 1.466 | 1.4616 | 1.4572 |

| 2024-03-14 | 1.4715 | 1.4671 | 1.4627 |

| 2024-03-13 | 1.471 | 1.4666 | 1.4622 |

| 2024-03-12 | 1.477 | 1.4726 | 1.4682 |

| 2024-03-11 | 1.47 | 1.4656 | 1.4612 |

| 2024-03-08 | 1.4685 | 1.4641 | 1.4597 |

| 2024-03-07 | 1.4688 | 1.4644 | 1.46 |

| 2024-03-06 | 1.4699 | 1.4655 | 1.4611 |

| 2024-03-05 | 1.4721 | 1.4677 | 1.4633 |

| 2024-03-04 | 1.4806 | 1.4762 | 1.4718 |

| 2024-03-01 | 1.4749 | 1.4705 | 1.4661 |

| 2024-02-29 | 1.4691 | 1.4647 | 1.4603 |

| 2024-02-28 | 1.465 | 1.4606 | 1.4562 |

| 2024-02-27 | 1.4592 | 1.4548 | 1.4504 |

| 2024-02-26 | 1.4551 | 1.4507 | 1.4463 |

| 2024-02-23 | 1.4536 | 1.4493 | 1.445 |

| 2024-02-22 | 1.4497 | 1.4454 | 1.4411 |

| 2024-02-21 | 1.4422 | 1.4379 | 1.4336 |

| 2024-02-20 | 1.4405 | 1.4362 | 1.4319 |

| 2024-02-19 | 1.4511 | 1.4468 | 1.4425 |

| 2024-02-16 | 1.4583 | 1.4539 | 1.4495 |

| 2024-02-15 | 1.461 | 1.4566 | 1.4522 |

| 2024-02-14 | 1.4542 | 1.4499 | 1.4456 |

| 2024-02-13 | 1.4418 | 1.4375 | 1.4332 |

| 2024-02-12 | 1.4523 | 1.4480 | 1.4437 |

| 2024-02-09 | 1.4459 | 1.4416 | 1.4373 |

| 2024-02-08 | 1.4515 | 1.4472 | 1.4429 |

| 2024-02-07 | 1.4416 | 1.4373 | 1.433 |

| 2024-02-06 | 1.4489 | 1.4446 | 1.4403 |

| 2024-02-05 | 1.4442 | 1.4399 | 1.4356 |

| 2024-02-02 | 1.4397 | 1.4354 | 1.4311 |

| 2024-02-01 | 1.4383 | 1.4340 | 1.4297 |

| 2024-01-31 | 1.4263 | 1.4220 | 1.4177 |

| 2024-01-30 | 1.4312 | 1.4269 | 1.4226 |

| 2024-01-29 | 1.4263 | 1.4220 | 1.4177 |

| 2024-01-25 | 1.4156 | 1.4114 | 1.4072 |

| 2024-01-24 | 1.409 | 1.4048 | 1.4006 |

| 2024-01-23 | 1.407 | 1.4028 | 1.3986 |

| 2024-01-22 | 1.4058 | 1.4016 | 1.3974 |

| 2024-01-19 | 1.3972 | 1.3930 | 1.3888 |

| 2024-01-18 | 1.4022 | 1.3980 | 1.3938 |

| 2024-01-17 | 1.3951 | 1.3909 | 1.3867 |

| 2024-01-16 | 1.3915 | 1.3873 | 1.3831 |

| 2024-01-15 | 1.3902 | 1.3860 | 1.3818 |

| 2024-01-12 | 1.3909 | 1.3867 | 1.3825 |

| 2024-01-11 | 1.394 | 1.3898 | 1.3856 |

| 2024-01-10 | 1.397 | 1.3928 | 1.3886 |

| 2024-01-09 | 1.3936 | 1.3894 | 1.3852 |

| 2024-01-08 | 1.3936 | 1.3894 | 1.3852 |

| 2024-01-05 | 1.3779 | 1.3738 | 1.3697 |

| 2024-01-04 | 1.3858 | 1.3817 | 1.3776 |

| 2024-01-03 | 1.3846 | 1.3805 | 1.3764 |

| 2024-01-02 | 1.4 | 1.3958 | 1.3916 |

| 2023-12-29 | 1.404 | 1.3998 | 1.3956 |

| 2023-12-28 | 1.402 | 1.3978 | 1.3936 |

| 2023-12-27 | 1.404 | 1.3998 | 1.3956 |

| 2023-12-22 | 1.3987 | 1.3945 | 1.3903 |

| 2023-12-21 | 1.3952 | 1.3910 | 1.3868 |

| 2023-12-20 | 1.3932 | 1.3890 | 1.3848 |

| 2023-12-19 | 1.3984 | 1.3942 | 1.39 |

| 2023-12-18 | 1.3916 | 1.3874 | 1.3832 |

| 2023-12-15 | 1.3805 | 1.3764 | 1.3723 |

| 2023-12-14 | 1.3881 | 1.3839 | 1.3797 |

| 2023-12-13 | 1.363 | 1.3589 | 1.3548 |

| 2023-12-12 | 1.3538 | 1.3498 | 1.3458 |

| 2023-12-11 | 1.3569 | 1.3528 | 1.3487 |

| 2023-12-08 | 1.3551 | 1.3510 | 1.3469 |

| 2023-12-07 | 1.3544 | 1.3503 | 1.3462 |

| 2023-12-06 | 1.3531 | 1.3491 | 1.3451 |

| 2023-12-05 | 1.3529 | 1.3489 | 1.3449 |

| 2023-12-04 | 1.3446 | 1.3406 | 1.3366 |

| 2023-12-01 | 1.3445 | 1.3405 | 1.3365 |

| 2023-11-30 | 1.3356 | 1.3316 | 1.3276 |

| 2023-11-29 | 1.3387 | 1.3347 | 1.3307 |

| 2023-11-28 | 1.329 | 1.3250 | 1.321 |

| 2023-11-27 | 1.3375 | 1.3335 | 1.3295 |

| 2023-11-24 | 1.3397 | 1.3357 | 1.3317 |

| 2023-11-23 | 1.3364 | 1.3324 | 1.3284 |

| 2023-11-22 | 1.3357 | 1.3317 | 1.3277 |

| 2023-11-21 | 1.3283 | 1.3243 | 1.3203 |

| 2023-11-20 | 1.3311 | 1.3271 | 1.3231 |

| 2023-11-17 | 1.3348 | 1.3308 | 1.3268 |

| 2023-11-16 | 1.3254 | 1.3214 | 1.3174 |

| 2023-11-15 | 1.3287 | 1.3247 | 1.3207 |

| 2023-11-14 | 1.3245 | 1.3205 | 1.3165 |

| 2023-11-13 | 1.298 | 1.2941 | 1.2902 |

| 2023-11-10 | 1.3016 | 1.2977 | 1.2938 |

| 2023-11-09 | 1.2907 | 1.2868 | 1.2829 |

| 2023-11-08 | 1.2876 | 1.2837 | 1.2798 |

| 2023-11-07 | 1.2878 | 1.2839 | 1.28 |

| 2023-11-06 | 1.2758 | 1.2720 | 1.2682 |

| 2023-11-03 | 1.2697 | 1.2659 | 1.2621 |

| 2023-11-02 | 1.2686 | 1.2648 | 1.261 |

| 2023-11-01 | 1.2569 | 1.2531 | 1.2493 |

| 2023-10-31 | 1.2593 | 1.2555 | 1.2517 |

| 2023-10-30 | 1.252 | 1.2483 | 1.2446 |

| 2023-10-27 | 1.2468 | 1.2431 | 1.2394 |

| 2023-10-26 | 1.2587 | 1.2549 | 1.2511 |

| 2023-10-25 | 1.2635 | 1.2597 | 1.2559 |

| 2023-10-24 | 1.274 | 1.2702 | 1.2664 |

| 2023-10-23 | 1.2738 | 1.2700 | 1.2662 |

| 2023-10-20 | 1.2826 | 1.2788 | 1.275 |

| 2023-10-19 | 1.2972 | 1.2933 | 1.2894 |

| 2023-10-18 | 1.3037 | 1.2998 | 1.2959 |

| 2023-10-17 | 1.318 | 1.3141 | 1.3102 |

| 2023-10-16 | 1.324 | 1.3200 | 1.316 |

| 2023-10-13 | 1.3248 | 1.3208 | 1.3168 |

| 2023-10-12 | 1.3334 | 1.3294 | 1.3254 |

| 2023-10-11 | 1.3311 | 1.3271 | 1.3231 |

| 2023-10-10 | 1.3306 | 1.3266 | 1.3226 |

| 2023-10-09 | 1.3135 | 1.3096 | 1.3057 |

| 2023-10-06 | 1.3205 | 1.3166 | 1.3127 |

| 2023-10-05 | 1.315 | 1.3111 | 1.3072 |

| 2023-10-04 | 1.3148 | 1.3109 | 1.307 |

| 2023-10-03 | 1.3201 | 1.3162 | 1.3123 |

| 2023-09-29 | 1.3154 | 1.3115 | 1.3076 |

| 2023-09-28 | 1.3198 | 1.3159 | 1.312 |

| 2023-09-27 | 1.3176 | 1.3137 | 1.3098 |

| 2023-09-26 | 1.3078 | 1.3039 | 1.3 |

| 2023-09-25 | 1.3211 | 1.3171 | 1.3131 |

| 2023-09-22 | 1.3157 | 1.3118 | 1.3079 |

| 2023-09-21 | 1.3255 | 1.3215 | 1.3175 |

| 2023-09-20 | 1.3315 | 1.3275 | 1.3235 |

| 2023-09-19 | 1.3337 | 1.3297 | 1.3257 |

| 2023-09-18 | 1.3435 | 1.3395 | 1.3355 |

| 2023-09-15 | 1.3513 | 1.3473 | 1.3433 |

| 2023-09-14 | 1.3542 | 1.3501 | 1.346 |

| 2023-09-13 | 1.3524 | 1.3484 | 1.3444 |

| 2023-09-12 | 1.3623 | 1.3582 | 1.3541 |

| 2023-09-11 | 1.3638 | 1.3597 | 1.3556 |

| 2023-09-08 | 1.3671 | 1.3630 | 1.3589 |

| 2023-09-07 | 1.3725 | 1.3684 | 1.3643 |

| 2023-09-06 | 1.3838 | 1.3797 | 1.3756 |

| 2023-09-05 | 1.392 | 1.3878 | 1.3836 |

| 2023-09-04 | 1.3924 | 1.3882 | 1.384 |

| 2023-09-01 | 1.3933 | 1.3891 | 1.3849 |

| 2023-08-31 | 1.3826 | 1.3785 | 1.3744 |

| 2023-08-30 | 1.3842 | 1.3801 | 1.376 |

| 2023-08-29 | 1.3813 | 1.3772 | 1.3731 |

| 2023-08-28 | 1.3734 | 1.3693 | 1.3652 |

| 2023-08-25 | 1.3724 | 1.3683 | 1.3642 |

| 2023-08-24 | 1.3679 | 1.3638 | 1.3597 |

| 2023-08-23 | 1.3712 | 1.3671 | 1.363 |

| 2023-08-22 | 1.3692 | 1.3651 | 1.361 |

| 2023-08-21 | 1.3695 | 1.3654 | 1.3613 |

| 2023-08-18 | 1.3919 | 1.3877 | 1.3835 |

| 2023-08-17 | 1.3921 | 1.3879 | 1.3837 |

| 2023-08-16 | 1.3939 | 1.3897 | 1.3855 |

| 2023-08-15 | 1.3981 | 1.3939 | 1.3897 |

| 2023-08-14 | 1.4082 | 1.4040 | 1.3998 |

| 2023-08-11 | 1.409 | 1.4048 | 1.4006 |

| 2023-08-10 | 1.3988 | 1.3946 | 1.3904 |

| 2023-08-09 | 1.4036 | 1.3994 | 1.3952 |

| 2023-08-08 | 1.4104 | 1.4062 | 1.402 |

| 2023-08-07 | 1.4057 | 1.4015 | 1.3973 |

| 2023-08-04 | 1.398 | 1.3938 | 1.3896 |

| 2023-08-03 | 1.4094 | 1.4052 | 1.401 |

| 2023-08-02 | 1.4147 | 1.4105 | 1.4063 |

| 2023-08-01 | 1.4191 | 1.4149 | 1.4107 |

| 2023-07-31 | 1.395 | 1.3908 | 1.3866 |

| 2023-07-28 | 1.4052 | 1.4010 | 1.3968 |

| 2023-07-27 | 1.3899 | 1.3857 | 1.3815 |

| 2023-07-26 | 1.3936 | 1.3894 | 1.3852 |

| 2023-07-25 | 1.3851 | 1.3810 | 1.3769 |

| 2023-07-24 | 1.3816 | 1.3775 | 1.3734 |

| 2023-07-21 | 1.384 | 1.3799 | 1.3758 |

| 2023-07-20 | 1.38 | 1.3759 | 1.3718 |

| 2023-07-19 | 1.4024 | 1.3982 | 1.394 |

| 2023-07-18 | 1.3871 | 1.3830 | 1.3789 |

| 2023-07-17 | 1.3763 | 1.3722 | 1.3681 |

| 2023-07-14 | 1.3674 | 1.3633 | 1.3592 |

| 2023-07-13 | 1.362 | 1.3579 | 1.3538 |

| 2023-07-12 | 1.3608 | 1.3567 | 1.3526 |

| 2023-07-11 | 1.3728 | 1.3687 | 1.3646 |

| 2023-07-10 | 1.3536 | 1.3496 | 1.3456 |

| 2023-07-07 | 1.3449 | 1.3409 | 1.3369 |

| 2023-07-06 | 1.341 | 1.3370 | 1.333 |

| 2023-07-05 | 1.3465 | 1.3425 | 1.3385 |

| 2023-07-04 | 1.3593 | 1.3552 | 1.3511 |

| 2023-07-03 | 1.3603 | 1.3562 | 1.3521 |

| 2023-06-30 | 1.3745 | 1.3704 | 1.3663 |

| 2023-06-29 | 1.3717 | 1.3676 | 1.3635 |

| 2023-06-28 | 1.374 | 1.3699 | 1.3658 |

| 2023-06-27 | 1.3503 | 1.3463 | 1.3423 |

| 2023-06-26 | 1.3422 | 1.3382 | 1.3342 |

| 2023-06-23 | 1.3396 | 1.3356 | 1.3316 |

| 2023-06-22 | 1.3394 | 1.3354 | 1.3314 |

| 2023-06-21 | 1.3469 | 1.3429 | 1.3389 |

| 2023-06-20 | 1.3501 | 1.3461 | 1.3421 |

| 2023-06-19 | 1.3402 | 1.3362 | 1.3322 |

| 2023-06-16 | 1.3453 | 1.3413 | 1.3373 |

| 2023-06-15 | 1.3502 | 1.3462 | 1.3422 |

| 2023-06-14 | 1.3495 | 1.3455 | 1.3415 |

| 2023-06-13 | 1.3576 | 1.3535 | 1.3494 |

| 2023-06-09 | 1.3472 | 1.3432 | 1.3392 |

| 2023-06-08 | 1.3549 | 1.3508 | 1.3467 |

| 2023-06-07 | 1.3631 | 1.3590 | 1.3549 |

| 2023-06-06 | 1.3498 | 1.3458 | 1.3418 |

| 2023-06-05 | 1.3478 | 1.3438 | 1.3398 |

| 2023-06-02 | 1.3576 | 1.3535 | 1.3494 |

| 2023-06-01 | 1.3387 | 1.3347 | 1.3307 |

| 2023-05-31 | 1.3426 | 1.3386 | 1.3346 |

| 2023-05-30 | 1.3416 | 1.3376 | 1.3336 |

| 2023-05-29 | 1.3378 | 1.3338 | 1.3298 |

| 2023-05-26 | 1.344 | 1.3400 | 1.336 |

| 2023-05-25 | 1.3356 | 1.3316 | 1.3276 |

| 2023-05-24 | 1.339 | 1.3350 | 1.331 |

| 2023-05-23 | 1.3449 | 1.3409 | 1.3369 |

| 2023-05-22 | 1.3444 | 1.3404 | 1.3364 |

| 2023-05-19 | 1.3362 | 1.3296 | 1.323 |

| 2023-05-18 | 1.3414 | 1.3347 | 1.328 |

| 2023-05-17 | 1.3382 | 1.3315 | 1.3248 |

| 2023-05-16 | 1.3296 | 1.3230 | 1.3164 |

| 2023-05-15 | 1.3338 | 1.3272 | 1.3206 |

| 2023-05-12 | 1.3317 | 1.3251 | 1.3185 |

| 2023-05-11 | 1.3271 | 1.3205 | 1.3139 |

| 2023-05-10 | 1.3287 | 1.3221 | 1.3155 |

| 2023-05-09 | 1.3302 | 1.3236 | 1.317 |

| 2023-05-08 | 1.3279 | 1.3213 | 1.3147 |

| 2023-05-05 | 1.3324 | 1.3258 | 1.3192 |

| 2023-05-04 | 1.3229 | 1.3163 | 1.3097 |

| 2023-05-03 | 1.3326 | 1.3260 | 1.3194 |

| 2023-05-02 | 1.3271 | 1.3205 | 1.3139 |

| 2023-05-01 | 1.3439 | 1.3372 | 1.3305 |

| 2023-04-28 | 1.3492 | 1.3425 | 1.3358 |

| 2023-04-27 | 1.3386 | 1.3319 | 1.3252 |

| 2023-04-26 | 1.3203 | 1.3137 | 1.3071 |

| 2023-04-24 | 1.3302 | 1.3236 | 1.317 |

| 2023-04-21 | 1.3278 | 1.3212 | 1.3146 |

| 2023-04-20 | 1.3162 | 1.3097 | 1.3032 |

| 2023-04-19 | 1.3225 | 1.3159 | 1.3093 |

| 2023-04-18 | 1.3248 | 1.3182 | 1.3116 |

| 2023-04-17 | 1.3306 | 1.3240 | 1.3174 |

| 2023-04-14 | 1.3284 | 1.3218 | 1.3152 |

| 2023-04-13 | 1.3176 | 1.3110 | 1.3044 |

| 2023-04-12 | 1.3222 | 1.3156 | 1.309 |

| 2023-04-11 | 1.321 | 1.3144 | 1.3078 |

| 2023-04-06 | 1.3061 | 1.2996 | 1.2931 |

| 2023-04-05 | 1.3031 | 1.2966 | 1.2901 |

| 2023-04-04 | 1.3146 | 1.3081 | 1.3016 |

| 2023-04-03 | 1.3143 | 1.3078 | 1.3013 |

| 2023-03-31 | 1.3306 | 1.3240 | 1.3174 |

| 2023-03-30 | 1.3124 | 1.3059 | 1.2994 |

| 2023-03-29 | 1.3063 | 1.2998 | 1.2933 |

| 2023-03-28 | 1.2928 | 1.2864 | 1.28 |

| 2023-03-27 | 1.3041 | 1.2976 | 1.2911 |

| 2023-03-24 | 1.296 | 1.2896 | 1.2832 |

| 2023-03-23 | 1.2901 | 1.2837 | 1.2773 |

| 2023-03-22 | 1.2848 | 1.2784 | 1.272 |

| 2023-03-21 | 1.3013 | 1.2948 | 1.2883 |

| 2023-03-20 | 1.2688 | 1.2625 | 1.2562 |

| 2023-03-17 | 1.2685 | 1.2622 | 1.2559 |

| 2023-03-16 | 1.2882 | 1.2818 | 1.2754 |

| 2023-03-15 | 1.2766 | 1.2702 | 1.2638 |

| 2023-03-14 | 1.292 | 1.2856 | 1.2792 |

| 2023-03-13 | 1.2785 | 1.2721 | 1.2657 |

| 2023-03-10 | 1.2992 | 1.2927 | 1.2862 |

| 2023-03-09 | 1.3235 | 1.3169 | 1.3103 |

| 2023-03-08 | 1.3402 | 1.3335 | 1.3268 |

| 2023-03-07 | 1.3443 | 1.3376 | 1.3309 |

| 2023-03-06 | 1.3397 | 1.3330 | 1.3263 |

| 2023-03-03 | 1.3415 | 1.3348 | 1.3281 |

| 2023-03-02 | 1.3286 | 1.3220 | 1.3154 |

| 2023-03-01 | 1.3199 | 1.3133 | 1.3067 |

| 2023-02-28 | 1.314 | 1.3075 | 1.301 |

| 2023-02-27 | 1.3132 | 1.3067 | 1.3002 |

| 2023-02-24 | 1.3077 | 1.3012 | 1.2947 |

| 2023-02-23 | 1.3045 | 1.2980 | 1.2915 |

| 2023-02-22 | 1.3015 | 1.2950 | 1.2885 |

| 2023-02-21 | 1.3034 | 1.2969 | 1.2904 |

| 2023-02-20 | 1.3177 | 1.3111 | 1.3045 |

| 2023-02-17 | 1.3276 | 1.3210 | 1.3144 |

| 2023-02-16 | 1.337 | 1.3303 | 1.3236 |

| 2023-02-15 | 1.3396 | 1.3329 | 1.3262 |

| 2023-02-14 | 1.3235 | 1.3169 | 1.3103 |

| 2023-02-13 | 1.3237 | 1.3171 | 1.3105 |

| 2023-02-10 | 1.3174 | 1.3108 | 1.3042 |

| 2023-02-09 | 1.3183 | 1.3117 | 1.3051 |

| 2023-02-08 | 1.3136 | 1.3071 | 1.3006 |

| 2023-02-07 | 1.3233 | 1.3167 | 1.3101 |

| 2023-02-06 | 1.3228 | 1.3162 | 1.3096 |

| 2023-02-03 | 1.322 | 1.3154 | 1.3088 |

| 2023-02-02 | 1.3137 | 1.3072 | 1.3007 |

| 2023-02-01 | 1.2899 | 1.2835 | 1.2771 |

| 2023-01-31 | 1.2837 | 1.2773 | 1.2709 |

| 2023-01-30 | 1.2765 | 1.2701 | 1.2637 |

| 2023-01-27 | 1.2814 | 1.2750 | 1.2686 |

| 2023-01-25 | 1.2802 | 1.2738 | 1.2674 |

| 2023-01-24 | 1.2899 | 1.2835 | 1.2771 |

| 2023-01-23 | 1.2902 | 1.2838 | 1.2774 |

| 2023-01-20 | 1.2841 | 1.2777 | 1.2713 |

| 2023-01-19 | 1.2806 | 1.2742 | 1.2678 |

| 2023-01-18 | 1.2795 | 1.2731 | 1.2667 |

| 2023-01-17 | 1.2834 | 1.2770 | 1.2706 |

| 2023-01-16 | 1.2894 | 1.2830 | 1.2766 |

| 2023-01-13 | 1.2855 | 1.2791 | 1.2727 |

| 2023-01-12 | 1.2811 | 1.2747 | 1.2683 |

| 2023-01-11 | 1.2693 | 1.2630 | 1.2567 |

| 2023-01-10 | 1.2672 | 1.2609 | 1.2546 |

| 2023-01-09 | 1.2475 | 1.2413 | 1.2351 |

| 2023-01-06 | 1.2443 | 1.2381 | 1.2319 |

| 2023-01-05 | 1.2348 | 1.2287 | 1.2226 |

| 2023-01-04 | 1.2262 | 1.2201 | 1.214 |

| 2023-01-03 | 1.2309 | 1.2248 | 1.2187 |

| 2022-12-30 | 1.2222 | 1.2161 | 1.21 |

| 2022-12-29 | 1.2227 | 1.2166 | 1.2105 |

| 2022-12-28 | 1.2053 | 1.1993 | 1.1933 |

| 2022-12-23 | 1.2235 | 1.2174 | 1.2113 |

| 2022-12-22 | 1.2275 | 1.2214 | 1.2153 |

| 2022-12-21 | 1.2337 | 1.2276 | 1.2215 |

| 2022-12-20 | 1.2304 | 1.2243 | 1.2182 |

| 2022-12-19 | 1.2216 | 1.2155 | 1.2094 |

| 2022-12-16 | 1.2321 | 1.2260 | 1.2199 |

| 2022-12-15 | 1.2367 | 1.2305 | 1.2243 |

| 2022-12-14 | 1.2443 | 1.2381 | 1.2319 |

| 2022-12-13 | 1.2344 | 1.2283 | 1.2222 |

| 2022-12-12 | 1.238 | 1.2318 | 1.2256 |

| 2022-12-09 | 1.2248 | 1.2187 | 1.2126 |

| 2022-12-08 | 1.2201 | 1.2140 | 1.2079 |

| 2022-12-07 | 1.2226 | 1.2165 | 1.2104 |

| 2022-12-06 | 1.2377 | 1.2315 | 1.2253 |

| 2022-12-05 | 1.2459 | 1.2397 | 1.2335 |

| 2022-12-02 | 1.2527 | 1.2465 | 1.2403 |

| 2022-12-01 | 1.2439 | 1.2377 | 1.2315 |

| 2022-11-30 | 1.2393 | 1.2331 | 1.2269 |

| 2022-11-29 | 1.228 | 1.2219 | 1.2158 |

| 2022-11-28 | 1.232 | 1.2259 | 1.2198 |

| 2022-11-25 | 1.2403 | 1.2341 | 1.2279 |

| 2022-11-24 | 1.2364 | 1.2302 | 1.224 |

| 2022-11-23 | 1.2346 | 1.2285 | 1.2224 |

| 2022-11-22 | 1.2363 | 1.2301 | 1.2239 |

| 2022-11-21 | 1.2326 | 1.2265 | 1.2204 |

| 2022-11-18 | 1.2294 | 1.2233 | 1.2172 |

| 2022-11-17 | 1.2332 | 1.2271 | 1.221 |

| 2022-11-16 | 1.2243 | 1.2182 | 1.2121 |

| 2022-11-15 | 1.2417 | 1.2355 | 1.2293 |

| 2022-11-14 | 1.2428 | 1.2366 | 1.2304 |

| 2022-11-11 | 1.2535 | 1.2473 | 1.2411 |

| 2022-11-10 | 1.2374 | 1.2312 | 1.225 |

| 2022-11-09 | 1.214 | 1.2080 | 1.202 |

| 2022-11-08 | 1.2179 | 1.2118 | 1.2057 |

| 2022-11-07 | 1.2135 | 1.2075 | 1.2015 |

| 2022-11-04 | 1.1998 | 1.1938 | 1.1878 |

| 2022-11-03 | 1.2089 | 1.2029 | 1.1969 |

| 2022-11-02 | 1.1987 | 1.1927 | 1.1867 |

| 2022-11-01 | 1.2183 | 1.2122 | 1.2061 |

| 2022-10-31 | 1.2137 | 1.2077 | 1.2017 |

| 2022-10-28 | 1.1971 | 1.1911 | 1.1851 |

| 2022-10-27 | 1.1776 | 1.1717 | 1.1658 |

| 2022-10-26 | 1.1786 | 1.1727 | 1.1668 |

| 2022-10-25 | 1.1767 | 1.1708 | 1.1649 |

| 2022-10-24 | 1.1708 | 1.1650 | 1.1592 |

| 2022-10-21 | 1.1613 | 1.1555 | 1.1497 |

| 2022-10-20 | 1.1453 | 1.1396 | 1.1339 |

| 2022-10-19 | 1.1529 | 1.1472 | 1.1415 |

| 2022-10-18 | 1.1644 | 1.1586 | 1.1528 |

| 2022-10-17 | 1.1561 | 1.1503 | 1.1445 |

| 2022-10-14 | 1.1434 | 1.1377 | 1.132 |

| 2022-10-13 | 1.1546 | 1.1489 | 1.1432 |

| 2022-10-12 | 1.1348 | 1.1292 | 1.1236 |

| 2022-10-11 | 1.1376 | 1.1319 | 1.1262 |

| 2022-10-10 | 1.1501 | 1.1444 | 1.1387 |

| 2022-10-07 | 1.1395 | 1.1338 | 1.1281 |

| 2022-10-06 | 1.1512 | 1.1455 | 1.1398 |

| 2022-10-05 | 1.1496 | 1.1439 | 1.1382 |

| 2022-10-04 | 1.1538 | 1.1481 | 1.1424 |

| 2022-09-30 | 1.1206 | 1.1150 | 1.1094 |

| 2022-09-29 | 1.1114 | 1.1059 | 1.1004 |

| 2022-09-28 | 1.1189 | 1.1133 | 1.1077 |

| 2022-09-27 | 1.1114 | 1.1059 | 1.1004 |

| 2022-09-26 | 1.0997 | 1.0942 | 1.0887 |

| 2022-09-23 | 1.1031 | 1.0976 | 1.0921 |

| 2022-09-21 | 1.1296 | 1.1240 | 1.1184 |

| 2022-09-20 | 1.131 | 1.1254 | 1.1198 |

| 2022-09-19 | 1.1399 | 1.1342 | 1.1285 |

| 2022-09-16 | 1.1519 | 1.1462 | 1.1405 |

| 2022-09-15 | 1.1644 | 1.1586 | 1.1528 |

| 2022-09-14 | 1.1638 | 1.1580 | 1.1522 |

| 2022-09-13 | 1.1671 | 1.1613 | 1.1555 |

| 2022-09-12 | 1.1763 | 1.1704 | 1.1645 |

| 2022-09-09 | 1.1799 | 1.1740 | 1.1681 |

| 2022-09-08 | 1.1734 | 1.1676 | 1.1618 |

| 2022-09-07 | 1.1625 | 1.1567 | 1.1509 |

| 2022-09-06 | 1.1592 | 1.1534 | 1.1476 |

| 2022-09-05 | 1.1456 | 1.1399 | 1.1342 |

| 2022-09-02 | 1.149 | 1.1433 | 1.1376 |

| 2022-09-01 | 1.156 | 1.1502 | 1.1444 |

| 2022-08-31 | 1.1637 | 1.1579 | 1.1521 |

| 2022-08-30 | 1.1528 | 1.1471 | 1.1414 |

| 2022-08-29 | 1.1542 | 1.1485 | 1.1428 |

| 2022-08-26 | 1.1643 | 1.1585 | 1.1527 |

| 2022-08-25 | 1.1804 | 1.1745 | 1.1686 |

| 2022-08-24 | 1.1792 | 1.1733 | 1.1674 |

| 2022-08-23 | 1.1766 | 1.1707 | 1.1648 |

| 2022-08-22 | 1.1816 | 1.1757 | 1.1698 |

| 2022-08-19 | 1.2052 | 1.1992 | 1.1932 |

| 2022-08-18 | 1.218 | 1.2119 | 1.2058 |

| 2022-08-17 | 1.2183 | 1.2122 | 1.2061 |

| 2022-08-16 | 1.2124 | 1.2064 | 1.2004 |

| 2022-08-15 | 1.207 | 1.2010 | 1.195 |

| 2022-08-12 | 1.201 | 1.1950 | 1.189 |

| 2022-08-11 | 1.2016 | 1.1956 | 1.1896 |

| 2022-08-10 | 1.2063 | 1.2003 | 1.1943 |

| 2022-08-09 | 1.1988 | 1.1928 | 1.1868 |

| 2022-08-08 | 1.213 | 1.2070 | 1.201 |

| 2022-08-05 | 1.2178 | 1.2117 | 1.2056 |

| 2022-08-04 | 1.223 | 1.2169 | 1.2108 |

| 2022-08-03 | 1.2245 | 1.2184 | 1.2123 |

| 2022-08-02 | 1.2127 | 1.2067 | 1.2007 |

| 2022-08-01 | 1.2078 | 1.2018 | 1.1958 |

| 2022-07-29 | 1.2112 | 1.2052 | 1.1992 |

| 2022-07-28 | 1.1911 | 1.1852 | 1.1793 |

| 2022-07-27 | 1.1834 | 1.1775 | 1.1716 |

| 2022-07-26 | 1.1657 | 1.1599 | 1.1541 |

| 2022-07-25 | 1.1868 | 1.1809 | 1.175 |

| 2022-07-22 | 1.1854 | 1.1795 | 1.1736 |

| 2022-07-21 | 1.1865 | 1.1806 | 1.1747 |

| 2022-07-20 | 1.17 | 1.1642 | 1.1584 |

| 2022-07-19 | 1.1598 | 1.1540 | 1.1482 |

| 2022-07-18 | 1.1459 | 1.1402 | 1.1345 |

| 2022-07-15 | 1.1369 | 1.1312 | 1.1255 |

| 2022-07-14 | 1.1339 | 1.1283 | 1.1227 |

| 2022-07-13 | 1.1336 | 1.1280 | 1.1224 |

| 2022-07-12 | 1.1396 | 1.1339 | 1.1282 |

| 2022-07-11 | 1.1459 | 1.1402 | 1.1345 |

| 2022-07-08 | 1.1464 | 1.1407 | 1.135 |

| 2022-07-07 | 1.1447 | 1.1390 | 1.1333 |

| 2022-07-06 | 1.139 | 1.1333 | 1.1276 |

| 2022-07-05 | 1.1377 | 1.1320 | 1.1263 |

| 2022-07-04 | 1.1313 | 1.1257 | 1.1201 |

| 2022-07-01 | 1.141 | 1.1353 | 1.1296 |

| 2022-06-30 | 1.1312 | 1.1256 | 1.12 |

| 2022-06-29 | 1.1419 | 1.1362 | 1.1305 |

| 2022-06-28 | 1.1457 | 1.1400 | 1.1343 |

| 2022-06-27 | 1.1536 | 1.1479 | 1.1422 |

| 2022-06-24 | 1.1453 | 1.1396 | 1.1339 |

| 2022-06-23 | 1.1312 | 1.1256 | 1.12 |

| 2022-06-22 | 1.119 | 1.1134 | 1.1078 |

| 2022-06-21 | 1.1191 | 1.1135 | 1.1079 |

| 2022-06-20 | 1.1105 | 1.1050 | 1.0995 |

| 2022-06-17 | 1.1178 | 1.1122 | 1.1066 |

| 2022-06-16 | 1.1125 | 1.1070 | 1.1015 |

| 2022-06-15 | 1.1309 | 1.1253 | 1.1197 |

| 2022-06-14 | 1.1331 | 1.1275 | 1.1219 |

| 2022-06-10 | 1.1763 | 1.1704 | 1.1645 |

| 2022-06-09 | 1.1909 | 1.1850 | 1.1791 |

| 2022-06-08 | 1.1975 | 1.1915 | 1.1855 |

| 2022-06-07 | 1.1993 | 1.1933 | 1.1873 |

| 2022-06-06 | 1.2015 | 1.1955 | 1.1895 |

| 2022-06-03 | 1.1958 | 1.1899 | 1.184 |

| 2022-06-02 | 1.2 | 1.1940 | 1.188 |

| 2022-06-01 | 1.1987 | 1.1927 | 1.1867 |

| 2022-05-31 | 1.2103 | 1.2043 | 1.1983 |

| 2022-05-30 | 1.2078 | 1.2018 | 1.1958 |

| 2022-05-27 | 1.1966 | 1.1906 | 1.1846 |

| 2022-05-26 | 1.188 | 1.1821 | 1.1762 |

| 2022-05-25 | 1.1783 | 1.1724 | 1.1665 |

| 2022-05-24 | 1.1754 | 1.1696 | 1.1638 |

| 2022-05-23 | 1.1877 | 1.1818 | 1.1759 |

| 2022-05-20 | 1.1865 | 1.1806 | 1.1747 |

| 2022-05-19 | 1.1876 | 1.1817 | 1.1758 |

| 2022-05-18 | 1.1789 | 1.1730 | 1.1671 |

| 2022-05-17 | 1.1895 | 1.1836 | 1.1777 |

| 2022-05-16 | 1.1781 | 1.1722 | 1.1663 |

| 2022-05-13 | 1.1778 | 1.1719 | 1.166 |

| 2022-05-12 | 1.1687 | 1.1629 | 1.1571 |

| 2022-05-11 | 1.1583 | 1.1525 | 1.1467 |

| 2022-05-10 | 1.1688 | 1.1630 | 1.1572 |

| 2022-05-09 | 1.166 | 1.1602 | 1.1544 |

| 2022-05-06 | 1.1928 | 1.1869 | 1.181 |

| 2022-05-05 | 1.2067 | 1.2007 | 1.1947 |

| 2022-05-04 | 1.2197 | 1.2136 | 1.2075 |

| 2022-05-03 | 1.2206 | 1.2145 | 1.2084 |

| 2022-05-02 | 1.2263 | 1.2202 | 1.2141 |

| 2022-04-29 | 1.2326 | 1.2265 | 1.2204 |

| 2022-04-28 | 1.2431 | 1.2369 | 1.2307 |

| 2022-04-27 | 1.2367 | 1.2305 | 1.2243 |

| 2022-04-26 | 1.2386 | 1.2324 | 1.2262 |

| 2022-04-22 | 1.2512 | 1.2450 | 1.2388 |

| 2022-04-21 | 1.2512 | 1.2450 | 1.2388 |

| 2022-04-20 | 1.2516 | 1.2454 | 1.2392 |

| 2022-04-19 | 1.2626 | 1.2563 | 1.25 |

| 2022-04-14 | 1.262 | 1.2557 | 1.2494 |

| 2022-04-13 | 1.2701 | 1.2638 | 1.2575 |

| 2022-04-12 | 1.2577 | 1.2514 | 1.2451 |

| 2022-04-11 | 1.2614 | 1.2551 | 1.2488 |

| 2022-04-08 | 1.2648 | 1.2585 | 1.2522 |

| 2022-04-07 | 1.2585 | 1.2522 | 1.2459 |

| 2022-04-06 | 1.2626 | 1.2563 | 1.25 |

| 2022-04-05 | 1.2717 | 1.2654 | 1.2591 |

| 2022-04-04 | 1.2937 | 1.2873 | 1.2809 |

| 2022-04-01 | 1.3016 | 1.2951 | 1.2886 |

| 2022-03-31 | 1.3015 | 1.2950 | 1.2885 |

| 2022-03-30 | 1.3102 | 1.3037 | 1.2972 |

| 2022-03-29 | 1.3211 | 1.3145 | 1.3079 |

| 2022-03-28 | 1.2925 | 1.2861 | 1.2797 |

| 2022-03-25 | 1.2908 | 1.2844 | 1.278 |

| 2022-03-24 | 1.2891 | 1.2827 | 1.2763 |

| 2022-03-23 | 1.3015 | 1.2950 | 1.2885 |

| 2022-03-22 | 1.3176 | 1.3110 | 1.3044 |

| 2022-03-21 | 1.3142 | 1.3077 | 1.3012 |

| 2022-03-18 | 1.32 | 1.3134 | 1.3068 |

| 2022-03-17 | 1.3181 | 1.3115 | 1.3049 |

| 2022-03-16 | 1.3054 | 1.2989 | 1.2924 |

| 2022-03-15 | 1.2893 | 1.2829 | 1.2765 |

| 2022-03-14 | 1.2871 | 1.2807 | 1.2743 |

| 2022-03-11 | 1.2768 | 1.2704 | 1.264 |

| 2022-03-10 | 1.2829 | 1.2765 | 1.2701 |

| 2022-03-09 | 1.2886 | 1.2822 | 1.2758 |

| 2022-03-08 | 1.2678 | 1.2615 | 1.2552 |

| 2022-03-07 | 1.2508 | 1.2446 | 1.2384 |

| 2022-03-04 | 1.2706 | 1.2643 | 1.258 |

| 2022-03-03 | 1.3024 | 1.2959 | 1.2894 |

| 2022-03-02 | 1.337 | 1.3303 | 1.3236 |

| 2022-03-01 | 1.3413 | 1.3346 | 1.3279 |

| 2022-02-28 | 1.3551 | 1.3484 | 1.3417 |

| 2022-02-25 | 1.3499 | 1.3432 | 1.3365 |

| 2022-02-24 | 1.3383 | 1.3316 | 1.3249 |

| 2022-02-23 | 1.3421 | 1.3354 | 1.3287 |

| 2022-02-22 | 1.3522 | 1.3455 | 1.3388 |

| 2022-02-21 | 1.3644 | 1.3576 | 1.3508 |

| 2022-02-18 | 1.3784 | 1.3715 | 1.3646 |

| 2022-02-17 | 1.3835 | 1.3766 | 1.3697 |

| 2022-02-16 | 1.4077 | 1.4007 | 1.3937 |

| 2022-02-15 | 1.4086 | 1.4016 | 1.3946 |

| 2022-02-14 | 1.3979 | 1.3909 | 1.3839 |

| 2022-02-11 | 1.4188 | 1.4117 | 1.4046 |

| 2022-02-10 | 1.4102 | 1.4032 | 1.3962 |

| 2022-02-09 | 1.42 | 1.4129 | 1.4058 |

| 2022-02-08 | 1.4087 | 1.4017 | 1.3947 |

| 2022-02-07 | 1.4214 | 1.4143 | 1.4072 |

| 2022-02-04 | 1.4285 | 1.4214 | 1.4143 |

| 2022-02-03 | 1.4109 | 1.4039 | 1.3969 |

| 2022-02-02 | 1.439 | 1.4318 | 1.4246 |

| 2022-02-01 | 1.4325 | 1.4254 | 1.4183 |

| 2022-01-31 | 1.4221 | 1.4150 | 1.4079 |

| 2022-01-28 | 1.3984 | 1.3914 | 1.3844 |

| 2022-01-27 | 1.3812 | 1.3743 | 1.3674 |

| 2022-01-25 | 1.3798 | 1.3729 | 1.366 |

| 2022-01-24 | 1.3827 | 1.3758 | 1.3689 |

| 2022-01-21 | 1.404 | 1.3970 | 1.39 |

| 2022-01-20 | 1.4216 | 1.4145 | 1.4074 |

| 2022-01-19 | 1.427 | 1.4199 | 1.4128 |

| 2022-01-18 | 1.4345 | 1.4274 | 1.4203 |

| 2022-01-17 | 1.4521 | 1.4449 | 1.4377 |

| 2022-01-14 | 1.4549 | 1.4477 | 1.4405 |

| 2022-01-13 | 1.4537 | 1.4465 | 1.4393 |

| 2022-01-12 | 1.4566 | 1.4494 | 1.4422 |

| 2022-01-11 | 1.4446 | 1.4374 | 1.4302 |

| 2022-01-10 | 1.4511 | 1.4439 | 1.4367 |

| 2022-01-07 | 1.4671 | 1.4598 | 1.4525 |

| 2022-01-06 | 1.4765 | 1.4692 | 1.4619 |

| 2022-01-05 | 1.4815 | 1.4741 | 1.4667 |

| 2022-01-04 | 1.4784 | 1.4710 | 1.4636 |

| 2021-12-31 | 1.4682 | 1.4609 | 1.4536 |

| 2021-12-30 | 1.4679 | 1.4606 | 1.4533 |

| 2021-12-29 | 1.4615 | 1.4542 | 1.4469 |

| 2021-12-24 | 1.4417 | 1.4345 | 1.4273 |

| 2021-12-23 | 1.4401 | 1.4329 | 1.4257 |

| 2021-12-22 | 1.4366 | 1.4295 | 1.4224 |

| 2021-12-21 | 1.4302 | 1.4231 | 1.416 |

| 2021-12-20 | 1.4166 | 1.4096 | 1.4026 |

| 2021-12-17 | 1.4234 | 1.4163 | 1.4092 |

| 2021-12-16 | 1.4178 | 1.4107 | 1.4036 |

| 2021-12-15 | 1.4221 | 1.4150 | 1.4079 |

| 2021-12-14 | 1.4186 | 1.4115 | 1.4044 |

| 2021-12-13 | 1.4385 | 1.4313 | 1.4241 |

| 2021-12-10 | 1.4475 | 1.4403 | 1.4331 |

| 2021-12-09 | 1.4521 | 1.4449 | 1.4377 |

| 2021-12-08 | 1.4598 | 1.4525 | 1.4452 |

| 2021-12-07 | 1.4625 | 1.4552 | 1.4479 |

| 2021-12-06 | 1.442 | 1.4348 | 1.4276 |

| 2021-12-03 | 1.4416 | 1.4344 | 1.4272 |

| 2021-12-02 | 1.4432 | 1.4360 | 1.4288 |

| 2021-12-01 | 1.4382 | 1.4310 | 1.4238 |

| 2021-11-30 | 1.4483 | 1.4411 | 1.4339 |

| 2021-11-29 | 1.4592 | 1.4519 | 1.4446 |

| 2021-11-26 | 1.4684 | 1.4611 | 1.4538 |

| 2021-11-25 | 1.4798 | 1.4724 | 1.465 |

| 2021-11-24 | 1.4811 | 1.4737 | 1.4663 |

| 2021-11-23 | 1.4891 | 1.4817 | 1.4743 |

| 2021-11-22 | 1.4987 | 1.4912 | 1.4837 |

| 2021-11-19 | 1.5081 | 1.5006 | 1.4931 |

| 2021-11-18 | 1.5134 | 1.5059 | 1.4984 |

| 2021-11-17 | 1.5161 | 1.5086 | 1.5011 |

| 2021-11-16 | 1.5144 | 1.5069 | 1.4994 |

| 2021-11-15 | 1.5149 | 1.5074 | 1.4999 |

| 2021-11-12 | 1.5206 | 1.5130 | 1.5054 |

| 2021-11-11 | 1.5193 | 1.5117 | 1.5041 |

| 2021-11-10 | 1.5156 | 1.5081 | 1.5006 |

| 2021-11-09 | 1.5185 | 1.5109 | 1.5033 |

| 2021-11-08 | 1.5153 | 1.5078 | 1.5003 |

| 2021-11-05 | 1.5112 | 1.5037 | 1.4962 |

| 2021-11-04 | 1.5051 | 1.4976 | 1.4901 |

| 2021-11-03 | 1.4979 | 1.4904 | 1.4829 |

| 2021-11-02 | 1.4799 | 1.4725 | 1.4651 |

| 2021-11-01 | 1.4745 | 1.4672 | 1.4599 |

| 2021-10-29 | 1.4511 | 1.4439 | 1.4367 |

| 2021-10-28 | 1.4459 | 1.4387 | 1.4315 |

| 2021-10-27 | 1.4421 | 1.4349 | 1.4277 |

| 2021-10-26 | 1.4458 | 1.4386 | 1.4314 |

| 2021-10-25 | 1.4299 | 1.4228 | 1.4157 |

| 2021-10-22 | 1.4354 | 1.4283 | 1.4212 |

| 2021-10-21 | 1.4362 | 1.4291 | 1.422 |

| 2021-10-20 | 1.4333 | 1.4262 | 1.4191 |

| 2021-10-19 | 1.4311 | 1.4240 | 1.4169 |

| 2021-10-18 | 1.4359 | 1.4288 | 1.4217 |

| 2021-10-15 | 1.4344 | 1.4273 | 1.4202 |

| 2021-10-14 | 1.4267 | 1.4196 | 1.4125 |

| 2021-10-13 | 1.4253 | 1.4182 | 1.4111 |

| 2021-10-12 | 1.4167 | 1.4097 | 1.4027 |

| 2021-10-11 | 1.4069 | 1.3999 | 1.3929 |

| 2021-10-08 | 1.4243 | 1.4172 | 1.4101 |

| 2021-10-07 | 1.4175 | 1.4104 | 1.4033 |

| 2021-10-06 | 1.4098 | 1.4028 | 1.3958 |

| 2021-10-05 | 1.4193 | 1.4122 | 1.4051 |

| 2021-10-01 | 1.4291 | 1.4220 | 1.4149 |

| 2021-09-30 | 1.4387 | 1.4315 | 1.4243 |

| 2021-09-29 | 1.4399 | 1.4327 | 1.4255 |

| 2021-09-28 | 1.4451 | 1.4379 | 1.4307 |

| 2021-09-27 | 1.4665 | 1.4592 | 1.4519 |

| 2021-09-24 | 1.4721 | 1.4648 | 1.4575 |

| 2021-09-23 | 1.4677 | 1.4604 | 1.4531 |

| 2021-09-22 | 1.4629 | 1.4556 | 1.4483 |

| 2021-09-21 | 1.4649 | 1.4576 | 1.4503 |

| 2021-09-20 | 1.4617 | 1.4544 | 1.4471 |

| 2021-09-17 | 1.4921 | 1.4847 | 1.4773 |

| 2021-09-16 | 1.487 | 1.4796 | 1.4722 |

| 2021-09-15 | 1.483 | 1.4756 | 1.4682 |

| 2021-09-14 | 1.4846 | 1.4772 | 1.4698 |

| 2021-09-13 | 1.4777 | 1.4703 | 1.4629 |

| 2021-09-10 | 1.4806 | 1.4732 | 1.4658 |

| 2021-09-09 | 1.469 | 1.4617 | 1.4544 |

| 2021-09-08 | 1.479 | 1.4716 | 1.4642 |

| 2021-09-07 | 1.4743 | 1.4670 | 1.4597 |

| 2021-09-06 | 1.4752 | 1.4679 | 1.4606 |

| 2021-09-03 | 1.4721 | 1.4648 | 1.4575 |

| 2021-09-02 | 1.4831 | 1.4757 | 1.4683 |

| 2021-09-01 | 1.4847 | 1.4773 | 1.4699 |

| 2021-08-31 | 1.4879 | 1.4805 | 1.4731 |

| 2021-08-30 | 1.4875 | 1.4801 | 1.4727 |

| 2021-08-27 | 1.4833 | 1.4759 | 1.4685 |

| 2021-08-26 | 1.482 | 1.4746 | 1.4672 |

| 2021-08-25 | 1.472 | 1.4647 | 1.4574 |

| 2021-08-24 | 1.4705 | 1.4632 | 1.4559 |

| 2021-08-23 | 1.46 | 1.4527 | 1.4454 |

| 2021-08-20 | 1.4524 | 1.4452 | 1.438 |

| 2021-08-19 | 1.4411 | 1.4339 | 1.4267 |

| 2021-08-18 | 1.4478 | 1.4406 | 1.4334 |

| 2021-08-17 | 1.4444 | 1.4372 | 1.43 |

| 2021-08-16 | 1.4405 | 1.4333 | 1.4261 |

| 2021-08-13 | 1.4444 | 1.4372 | 1.43 |

| 2021-08-12 | 1.4433 | 1.4361 | 1.4289 |

| 2021-08-11 | 1.4357 | 1.4286 | 1.4215 |

| 2021-08-10 | 1.4381 | 1.4309 | 1.4237 |

| 2021-08-09 | 1.4368 | 1.4297 | 1.4226 |

| 2021-08-06 | 1.4383 | 1.4311 | 1.4239 |

| 2021-08-05 | 1.4261 | 1.4190 | 1.4119 |

| 2021-08-04 | 1.4499 | 1.4427 | 1.4355 |

| 2021-08-03 | 1.4518 | 1.4446 | 1.4374 |

| 2021-07-30 | 1.4468 | 1.4396 | 1.4324 |

| 2021-07-29 | 1.441 | 1.4338 | 1.4266 |

| 2021-07-28 | 1.4353 | 1.4282 | 1.4211 |

| 2021-07-27 | 1.4198 | 1.4127 | 1.4056 |

| 2021-07-26 | 1.4203 | 1.4132 | 1.4061 |

| 2021-07-23 | 1.4174 | 1.4103 | 1.4032 |

| 2021-07-22 | 1.4149 | 1.4079 | 1.4009 |

| 2021-07-21 | 1.4138 | 1.4068 | 1.3998 |

| 2021-07-20 | 1.4003 | 1.3933 | 1.3863 |

| 2021-07-19 | 1.3921 | 1.3852 | 1.3783 |

| 2021-07-16 | 1.4113 | 1.4043 | 1.3973 |

| 2021-07-15 | 1.4116 | 1.4046 | 1.3976 |

| 2021-07-14 | 1.4138 | 1.4068 | 1.3998 |

| 2021-07-13 | 1.4213 | 1.4142 | 1.4071 |

| 2021-07-12 | 1.4215 | 1.4144 | 1.4073 |

| 2021-07-09 | 1.4129 | 1.4059 | 1.3989 |

| 2021-07-08 | 1.4129 | 1.4059 | 1.3989 |

| 2021-07-07 | 1.4206 | 1.4135 | 1.4064 |

| 2021-07-06 | 1.408 | 1.4010 | 1.394 |

| 2021-07-05 | 1.4108 | 1.4038 | 1.3968 |

| 2021-07-02 | 1.4137 | 1.4067 | 1.3997 |

| 2021-07-01 | 1.415 | 1.4080 | 1.401 |

| 2021-06-30 | 1.6067 | 1.5987 | 1.5907 |

| 2021-06-29 | 1.6039 | 1.5959 | 1.5879 |

| 2021-06-28 | 1.5955 | 1.5876 | 1.5797 |

| 2021-06-25 | 1.6049 | 1.5969 | 1.5889 |

| 2021-06-24 | 1.5995 | 1.5915 | 1.5835 |

| 2021-06-23 | 1.5992 | 1.5912 | 1.5832 |

| 2021-06-22 | 1.611 | 1.6030 | 1.595 |

| 2021-06-21 | 1.6007 | 1.5927 | 1.5847 |

| 2021-06-18 | 1.6067 | 1.5987 | 1.5907 |

| 2021-06-17 | 1.6044 | 1.5964 | 1.5884 |

| 2021-06-16 | 1.6013 | 1.5933 | 1.5853 |

| 2021-06-15 | 1.6102 | 1.6022 | 1.5942 |

| 2021-06-11 | 1.606 | 1.5980 | 1.59 |

| 2021-06-10 | 1.59 | 1.5821 | 1.5742 |

| 2021-06-09 | 1.5965 | 1.5886 | 1.5807 |

| 2021-06-08 | 1.6021 | 1.5941 | 1.5861 |

| 2021-06-07 | 1.5978 | 1.5899 | 1.582 |

| 2021-06-04 | 1.5978 | 1.5899 | 1.582 |

| 2021-06-03 | 1.6001 | 1.5921 | 1.5841 |

| 2021-06-02 | 1.5939 | 1.5860 | 1.5781 |

| 2021-06-01 | 1.5842 | 1.5763 | 1.5684 |

| 2021-05-31 | 1.5823 | 1.5744 | 1.5665 |

| 2021-05-28 | 1.5875 | 1.5796 | 1.5717 |

| 2021-05-27 | 1.5696 | 1.5618 | 1.554 |

| 2021-05-26 | 1.5651 | 1.5573 | 1.5495 |

| 2021-05-25 | 1.5503 | 1.5426 | 1.5349 |

| 2021-05-24 | 1.556 | 1.5483 | 1.5406 |

| 2021-05-21 | 1.5486 | 1.5409 | 1.5332 |

| 2021-05-20 | 1.4847 | 1.4773 | 1.4699 |

| 2021-05-19 | 1.5313 | 1.5237 | 1.5161 |

| 2021-05-18 | 1.5311 | 1.5235 | 1.5159 |

| 2021-05-17 | 1.5133 | 1.5058 | 1.4983 |

| 2021-05-14 | 1.5118 | 1.5043 | 1.4968 |

| 2021-05-13 | 1.5028 | 1.4953 | 1.4879 |

| 2021-05-12 | 1.5107 | 1.5031 | 1.4956 |

| 2021-05-11 | 1.518 | 1.5104 | 1.5029 |

| 2021-05-10 | 1.5328 | 1.5251 | 1.5175 |

| 2021-05-07 | 1.5319 | 1.5243 | 1.5166 |

| 2021-05-06 | 1.5309 | 1.5233 | 1.5156 |

| 2021-05-05 | 1.524 | 1.5164 | 1.5088 |

| 2021-05-04 | 1.5291 | 1.5215 | 1.5139 |

| 2021-05-03 | 1.5385 | 1.5309 | 1.5232 |

| 2021-04-30 | 1.5383 | 1.5306 | 1.523 |

| 2021-04-29 | 1.547 | 1.5393 | 1.5316 |

| 2021-04-28 | 1.5457 | 1.5380 | 1.5303 |

| 2021-04-27 | 1.5436 | 1.5359 | 1.5282 |

| 2021-04-26 | 1.5391 | 1.5315 | 1.5238 |

| 2021-04-23 | 1.5457 | 1.5380 | 1.5303 |

| 2021-04-22 | 1.5443 | 1.5366 | 1.5289 |

| 2021-04-21 | 1.5332 | 1.5256 | 1.518 |

| 2021-04-20 | 1.5197 | 1.5122 | 1.5046 |

| 2021-04-19 | 1.5394 | 1.5317 | 1.5241 |

| 2021-04-16 | 1.5417 | 1.5340 | 1.5264 |

| 2021-04-15 | 1.5288 | 1.5212 | 1.5136 |

| 2021-04-14 | 1.5272 | 1.5196 | 1.512 |

| 2021-04-13 | 1.5247 | 1.5171 | 1.5095 |

| 2021-04-12 | 1.5183 | 1.5108 | 1.5032 |

| 2021-04-09 | 1.5213 | 1.5137 | 1.5061 |

| 2021-04-08 | 1.5141 | 1.5066 | 1.4991 |

| 2021-04-07 | 1.5007 | 1.4932 | 1.4857 |

| 2021-04-06 | 1.4958 | 1.4883 | 1.4809 |

| 2021-04-01 | 1.4915 | 1.4841 | 1.4767 |

| 2021-03-31 | 1.4704 | 1.4631 | 1.4558 |

| 2021-03-30 | 1.4689 | 1.4616 | 1.4543 |

| 2021-03-29 | 1.4607 | 1.4534 | 1.4461 |

| 2021-03-26 | 1.4681 | 1.4608 | 1.4535 |

| 2021-03-25 | 1.4638 | 1.4566 | 1.4493 |

| 2021-03-24 | 1.4561 | 1.4489 | 1.4416 |

| 2021-03-23 | 1.4565 | 1.4492 | 1.442 |

| 2021-03-22 | 1.4679 | 1.4606 | 1.4533 |

| 2021-03-19 | 1.4719 | 1.4646 | 1.4573 |

| 2021-03-18 | 1.4657 | 1.4584 | 1.4511 |

| 2021-03-17 | 1.4817 | 1.4743 | 1.467 |

| 2021-03-16 | 1.4734 | 1.4661 | 1.4588 |

| 2021-03-15 | 1.4757 | 1.4684 | 1.4611 |

| 2021-03-12 | 1.4689 | 1.4616 | 1.4543 |

| 2021-03-11 | 1.4648 | 1.4575 | 1.4502 |

| 2021-03-10 | 1.4609 | 1.4536 | 1.4463 |

| 2021-03-09 | 1.4517 | 1.4444 | 1.4372 |

| 2021-03-08 | 1.4358 | 1.4287 | 1.4216 |

| 2021-03-05 | 1.4303 | 1.4232 | 1.416 |

| 2021-03-04 | 1.4099 | 1.4028 | 1.3958 |

| 2021-03-03 | 1.4282 | 1.4211 | 1.414 |

| 2021-03-02 | 1.4235 | 1.4164 | 1.4093 |

| 2021-03-01 | 1.4295 | 1.4224 | 1.4153 |

| 2021-02-26 | 1.4256 | 1.4185 | 1.4114 |

| 2021-02-25 | 1.4118 | 1.4048 | 1.3978 |

| 2021-02-24 | 1.4087 | 1.4017 | 1.3947 |

| 2021-02-23 | 1.4025 | 1.3956 | 1.3886 |

| 2021-02-22 | 1.4108 | 1.4038 | 1.3968 |

| 2021-02-19 | 1.4171 | 1.4101 | 1.403 |

| 2021-02-18 | 1.4354 | 1.4282 | 1.4211 |

| 2021-02-17 | 1.4575 | 1.4503 | 1.443 |

| 2021-02-16 | 1.4748 | 1.4675 | 1.4602 |

| 2021-02-15 | 1.4717 | 1.4644 | 1.4571 |

| 2021-02-12 | 1.4714 | 1.4640 | 1.4567 |

| 2021-02-11 | 1.4719 | 1.4646 | 1.4572 |

| 2021-02-10 | 1.4643 | 1.4570 | 1.4497 |

| 2021-02-09 | 1.4587 | 1.4515 | 1.4442 |

| 2021-02-08 | 1.4508 | 1.4436 | 1.4364 |

| 2021-02-05 | 1.4409 | 1.4337 | 1.4265 |

| 2021-02-04 | 1.4341 | 1.4270 | 1.4198 |

| 2021-02-03 | 1.4342 | 1.4271 | 1.42 |

| 2021-02-02 | 1.4184 | 1.4114 | 1.4043 |

| 2021-02-01 | 1.3966 | 1.3896 | 1.3827 |

| 2021-01-29 | 1.3803 | 1.3734 | 1.3666 |

| 2021-01-28 | 1.388 | 1.3811 | 1.3742 |

| 2021-01-27 | 1.4086 | 1.4016 | 1.3946 |

| 2021-01-25 | 1.4099 | 1.4029 | 1.3959 |

| 2021-01-22 | 1.4079 | 1.4009 | 1.3939 |

| 2021-01-21 | 1.3989 | 1.3919 | 1.385 |

| 2021-01-20 | 1.3943 | 1.3873 | 1.3804 |

| 2021-01-19 | 1.3858 | 1.3789 | 1.372 |

| 2021-01-18 | 1.3757 | 1.3689 | 1.362 |

| 2021-01-15 | 1.3752 | 1.3683 | 1.3615 |

| 2021-01-14 | 1.3855 | 1.3786 | 1.3717 |

| 2021-01-13 | 1.3811 | 1.3742 | 1.3674 |

| 2021-01-12 | 1.3855 | 1.3786 | 1.3717 |

| 2021-01-11 | 1.3725 | 1.3657 | 1.3589 |

| 2021-01-08 | 1.3716 | 1.3648 | 1.358 |

| 2021-01-07 | 1.3802 | 1.3734 | 1.3665 |

| 2021-01-06 | 1.3752 | 1.3684 | 1.3615 |

| 2021-01-05 | 1.3772 | 1.3704 | 1.3635 |

| 2021-01-04 | 1.3697 | 1.3629 | 1.3561 |

| 2020-12-31 | 1.3566 | 1.3499 | 1.3431 |

| 2020-12-30 | 1.3601 | 1.3533 | 1.3466 |

| 2020-12-29 | 1.3593 | 1.3525 | 1.3458 |

| 2020-12-24 | 1.3552 | 1.3485 | 1.3417 |

| 2020-12-23 | 1.3502 | 1.3435 | 1.3368 |

| 2020-12-22 | 1.3432 | 1.3366 | 1.3299 |

| 2020-12-21 | 1.3322 | 1.3256 | 1.3189 |

| 2020-12-18 | 1.337 | 1.3303 | 1.3237 |

| 2020-12-17 | 1.3306 | 1.3240 | 1.3173 |

| 2020-12-16 | 1.3178 | 1.3112 | 1.3047 |

| 2020-12-15 | 1.3104 | 1.3039 | 1.2974 |

| 2020-12-14 | 1.2912 | 1.2848 | 1.2784 |

| 2020-12-11 | 1.2823 | 1.2759 | 1.2695 |

| 2020-12-10 | 1.2925 | 1.2861 | 1.2797 |

| 2020-12-09 | 1.3 | 1.2936 | 1.2871 |

| 2020-12-08 | 1.3093 | 1.3028 | 1.2963 |

| 2020-12-07 | 1.2889 | 1.2825 | 1.2761 |

| 2020-12-04 | 1.2956 | 1.2892 | 1.2827 |

| 2020-12-03 | 1.2787 | 1.2724 | 1.266 |

| 2020-12-02 | 1.2835 | 1.2771 | 1.2707 |

| 2020-12-01 | 1.2815 | 1.2751 | 1.2687 |

| 2020-11-30 | 1.2604 | 1.2542 | 1.2479 |

| 2020-11-27 | 1.2619 | 1.2556 | 1.2493 |

| 2020-11-26 | 1.2652 | 1.2589 | 1.2526 |

| 2020-11-25 | 1.264 | 1.2577 | 1.2514 |

| 2020-11-24 | 1.2675 | 1.2612 | 1.2549 |

| 2020-11-23 | 1.2594 | 1.2531 | 1.2469 |

| 2020-11-20 | 1.2422 | 1.2360 | 1.2298 |

| 2020-11-19 | 1.2497 | 1.2435 | 1.2372 |

| 2020-11-18 | 1.2229 | 1.2168 | 1.2107 |

| 2020-11-17 | 1.2269 | 1.2208 | 1.2147 |

| 2020-11-16 | 1.2254 | 1.2193 | 1.2132 |

| 2020-11-13 | 1.2202 | 1.2141 | 1.208 |

| 2020-11-12 | 1.1999 | 1.1939 | 1.188 |

| 2020-11-11 | 1.2062 | 1.2002 | 1.1942 |

| 2020-11-10 | 1.2086 | 1.2026 | 1.1966 |

| 2020-11-09 | 1.1975 | 1.1915 | 1.1856 |

| 2020-11-06 | 1.1721 | 1.1663 | 1.1605 |

| 2020-11-05 | 1.1699 | 1.1641 | 1.1582 |

| 2020-11-04 | 1.1711 | 1.1652 | 1.1594 |

| 2020-11-03 | 1.1624 | 1.1566 | 1.1508 |

| 2020-11-02 | 1.1559 | 1.1502 | 1.1444 |

| 2020-10-30 | 1.1506 | 1.1449 | 1.1392 |

| 2020-10-29 | 1.1567 | 1.1510 | 1.1452 |

| 2020-10-28 | 1.1588 | 1.1530 | 1.1473 |

| 2020-10-27 | 1.1768 | 1.1709 | 1.165 |

| 2020-10-26 | 1.1809 | 1.1750 | 1.1692 |

| 2020-10-23 | 1.2053 | 1.1993 | 1.1933 |

| 2020-10-22 | 1.2047 | 1.1987 | 1.1927 |

| 2020-10-21 | 1.2003 | 1.1943 | 1.1884 |

| 2020-10-20 | 1.2111 | 1.2051 | 1.1991 |

| 2020-10-19 | 1.2015 | 1.1956 | 1.1896 |

| 2020-10-16 | 1.2013 | 1.1953 | 1.1893 |

| 2020-10-15 | 1.1996 | 1.1936 | 1.1876 |

| 2020-10-14 | 1.1897 | 1.1838 | 1.1779 |

| 2020-10-13 | 1.1981 | 1.1921 | 1.1862 |

| 2020-10-12 | 1.1967 | 1.1908 | 1.1848 |

| 2020-10-09 | 1.1842 | 1.1783 | 1.1724 |

| 2020-10-08 | 1.186 | 1.1801 | 1.1742 |

| 2020-10-07 | 1.185 | 1.1791 | 1.1732 |

| 2020-10-06 | 1.1823 | 1.1764 | 1.1706 |

| 2020-10-02 | 1.1593 | 1.1535 | 1.1478 |

| 2020-10-01 | 1.1581 | 1.1523 | 1.1465 |

| 2020-09-30 | 1.1519 | 1.1461 | 1.1404 |

| 2020-09-29 | 1.1608 | 1.1551 | 1.1493 |

| 2020-09-28 | 1.1666 | 1.1608 | 1.155 |

| 2020-09-25 | 1.1562 | 1.1504 | 1.1447 |

| 2020-09-24 | 1.1525 | 1.1468 | 1.141 |

| 2020-09-23 | 1.1559 | 1.1501 | 1.1444 |

| 2020-09-22 | 1.1532 | 1.1474 | 1.1417 |

| 2020-09-21 | 1.1511 | 1.1454 | 1.1397 |

| 2020-09-18 | 1.1622 | 1.1564 | 1.1506 |

| 2020-09-17 | 1.1646 | 1.1588 | 1.153 |

| 2020-09-16 | 1.1708 | 1.1650 | 1.1591 |

| 2020-09-15 | 1.1636 | 1.1579 | 1.1521 |

| 2020-09-14 | 1.164 | 1.1582 | 1.1524 |

| 2020-09-11 | 1.1528 | 1.1471 | 1.1413 |

| 2020-09-10 | 1.1538 | 1.1481 | 1.1423 |

| 2020-09-09 | 1.1596 | 1.1539 | 1.1481 |

| 2020-09-08 | 1.1517 | 1.1460 | 1.1402 |

| 2020-09-07 | 1.1577 | 1.1519 | 1.1461 |

| 2020-09-04 | 1.1568 | 1.1510 | 1.1453 |

| 2020-09-03 | 1.1689 | 1.1631 | 1.1573 |

| 2020-09-02 | 1.1798 | 1.1739 | 1.168 |

| 2020-09-01 | 1.1685 | 1.1626 | 1.1568 |

| 2020-08-31 | 1.1626 | 1.1568 | 1.1511 |

| 2020-08-28 | 1.164 | 1.1582 | 1.1524 |

| 2020-08-27 | 1.1737 | 1.1679 | 1.162 |

| 2020-08-26 | 1.1734 | 1.1675 | 1.1617 |

| 2020-08-25 | 1.1819 | 1.1760 | 1.1701 |

| 2020-08-24 | 1.1812 | 1.1753 | 1.1694 |

| 2020-08-21 | 1.1764 | 1.1705 | 1.1647 |

| 2020-08-20 | 1.181 | 1.1751 | 1.1692 |

| 2020-08-19 | 1.1748 | 1.1689 | 1.1631 |

| 2020-08-18 | 1.1774 | 1.1715 | 1.1657 |

| 2020-08-17 | 1.1766 | 1.1707 | 1.1648 |

| 2020-08-14 | 1.1721 | 1.1663 | 1.1605 |

| 2020-08-13 | 1.184 | 1.1782 | 1.1723 |

| 2020-08-12 | 1.1599 | 1.1541 | 1.1483 |

| 2020-08-11 | 1.1579 | 1.1522 | 1.1464 |

| 2020-08-10 | 1.1543 | 1.1486 | 1.1429 |

| 2020-08-07 | 1.1493 | 1.1436 | 1.1379 |

| 2020-08-06 | 1.1455 | 1.1399 | 1.1342 |

| 2020-08-05 | 1.1532 | 1.1475 | 1.1417 |

| 2020-08-04 | 1.1441 | 1.1384 | 1.1327 |

| 2020-08-03 | 1.1473 | 1.1416 | 1.1359 |

| 2020-07-31 | 1.133 | 1.1274 | 1.1217 |

| 2020-07-30 | 1.1417 | 1.1360 | 1.1303 |

| 2020-07-29 | 1.1409 | 1.1352 | 1.1296 |

| 2020-07-28 | 1.1327 | 1.1270 | 1.1214 |

| 2020-07-27 | 1.1386 | 1.1330 | 1.1273 |

| 2020-07-24 | 1.1347 | 1.1291 | 1.1234 |

| 2020-07-23 | 1.1406 | 1.1349 | 1.1293 |

| 2020-07-22 | 1.1372 | 1.1315 | 1.1259 |

| 2020-07-21 | 1.1323 | 1.1267 | 1.121 |

| 2020-07-20 | 1.1267 | 1.1211 | 1.1155 |

| 2020-07-17 | 1.1306 | 1.1250 | 1.1194 |

| 2020-07-16 | 1.1186 | 1.1131 | 1.1075 |

| 2020-07-15 | 1.1167 | 1.1112 | 1.1056 |

| 2020-07-14 | 1.1074 | 1.1019 | 1.0963 |

| 2020-07-13 | 1.1078 | 1.1023 | 1.0968 |

| 2020-07-10 | 1.1165 | 1.1109 | 1.1054 |

| 2020-07-09 | 1.1149 | 1.1093 | 1.1038 |

| 2020-07-08 | 1.1177 | 1.1122 | 1.1066 |

| 2020-07-07 | 1.1156 | 1.1100 | 1.1045 |

| 2020-07-06 | 1.1164 | 1.1108 | 1.1053 |

| 2020-07-03 | 1.112 | 1.1065 | 1.1009 |

| 2020-07-02 | 1.1147 | 1.1091 | 1.1036 |

| 2020-07-01 | 1.1073 | 1.1018 | 1.0963 |

| 2020-06-30 | 1.1502 | 1.1445 | 1.1388 |

| 2020-06-29 | 1.1526 | 1.1468 | 1.1411 |

| 2020-06-26 | 1.1553 | 1.1496 | 1.1438 |

| 2020-06-25 | 1.1586 | 1.1528 | 1.147 |

| 2020-06-24 | 1.1611 | 1.1553 | 1.1495 |

| 2020-06-23 | 1.1665 | 1.1607 | 1.1549 |

| 2020-06-22 | 1.1665 | 1.1607 | 1.1549 |

| 2020-06-19 | 1.166 | 1.1602 | 1.1544 |

| 2020-06-18 | 1.1622 | 1.1564 | 1.1506 |

| 2020-06-17 | 1.1615 | 1.1557 | 1.1499 |

| 2020-06-16 | 1.169 | 1.1631 | 1.1573 |

| 2020-06-15 | 1.1459 | 1.1402 | 1.1345 |

| 2020-06-12 | 1.1417 | 1.1360 | 1.1304 |

| 2020-06-11 | 1.1371 | 1.1315 | 1.1258 |

| 2020-06-10 | 1.167 | 1.1612 | 1.1554 |

| 2020-06-09 | 1.1838 | 1.1779 | 1.172 |

| 2020-06-05 | 1.1782 | 1.1724 | 1.1665 |

| 2020-06-04 | 1.1565 | 1.1507 | 1.145 |

| 2020-06-03 | 1.1533 | 1.1476 | 1.1419 |

| 2020-06-02 | 1.1388 | 1.1331 | 1.1275 |

| 2020-06-01 | 1.1433 | 1.1376 | 1.1319 |

| 2020-05-29 | 1.1544 | 1.1487 | 1.1429 |

| 2020-05-28 | 1.1412 | 1.1355 | 1.1299 |

| 2020-05-27 | 1.1474 | 1.1417 | 1.136 |

| 2020-05-26 | 1.1338 | 1.1282 | 1.1225 |

| 2020-05-25 | 1.1322 | 1.1266 | 1.121 |

| 2020-05-22 | 1.1218 | 1.1162 | 1.1106 |

| 2020-05-21 | 1.1156 | 1.1101 | 1.1045 |

| 2020-05-20 | 1.1088 | 1.1033 | 1.0978 |

| 2020-05-19 | 1.0984 | 1.0929 | 1.0875 |

| 2020-05-18 | 1.1067 | 1.1012 | 1.0957 |

| 2020-05-15 | 1.088 | 1.0826 | 1.0772 |

| 2020-05-14 | 1.0691 | 1.0638 | 1.0585 |

| 2020-05-13 | 1.0809 | 1.0755 | 1.0701 |

| 2020-05-12 | 1.0924 | 1.0870 | 1.0815 |

| 2020-05-11 | 1.1048 | 1.0993 | 1.0938 |

| 2020-05-08 | 1.0914 | 1.0860 | 1.0806 |

| 2020-05-07 | 1.0833 | 1.0779 | 1.0725 |

| 2020-05-06 | 1.079 | 1.0736 | 1.0682 |

| 2020-05-05 | 1.0836 | 1.0783 | 1.0729 |

| 2020-05-04 | 1.0727 | 1.0674 | 1.062 |

| 2020-05-01 | 1.0912 | 1.0857 | 1.0803 |

| 2020-04-30 | 1.0889 | 1.0835 | 1.0781 |

| 2020-04-29 | 1.0939 | 1.0885 | 1.083 |

| 2020-04-28 | 1.0778 | 1.0724 | 1.067 |

| 2020-04-27 | 1.065 | 1.0597 | 1.0544 |

| 2020-04-24 | 1.0557 | 1.0504 | 1.0452 |

| 2020-04-23 | 1.0489 | 1.0436 | 1.0384 |

| 2020-04-22 | 1.0485 | 1.0433 | 1.038 |

| 2020-04-21 | 1.0444 | 1.0392 | 1.034 |

| 2020-04-20 | 1.0524 | 1.0471 | 1.0419 |

| 2020-04-17 | 1.0528 | 1.0476 | 1.0424 |

| 2020-04-16 | 1.0436 | 1.0384 | 1.0332 |

| 2020-04-15 | 1.0459 | 1.0407 | 1.0355 |

| 2020-04-14 | 1.0547 | 1.0494 | 1.0442 |

| 2020-04-09 | 1.0543 | 1.0491 | 1.0438 |

| 2020-04-08 | 1.041 | 1.0358 | 1.0307 |

| 2020-04-07 | 1.034 | 1.0288 | 1.0237 |

| 2020-04-06 | 1.0182 | 1.0131 | 1.0081 |

| 2020-04-03 | 0.9947 | 0.9897 | 0.9848 |

| 2020-04-02 | 0.9978 | 0.9928 | 0.9878 |

| 2020-04-01 | 0.9866 | 0.9817 | 0.9768 |

| 2020-03-31 | 1.0106 | 1.0056 | 1.0006 |

| 2020-03-30 | 0.9865 | 0.9816 | 0.9767 |

| 2020-03-27 | 0.9857 | 0.9808 | 0.9759 |

| 2020-03-26 | 1.0196 | 1.0145 | 1.0095 |

| 2020-03-25 | 0.9906 | 0.9857 | 0.9808 |

| 2020-03-24 | 0.9676 | 0.9627 | 0.9579 |

| 2020-03-23 | 0.9376 | 0.9329 | 0.9283 |

| 2020-03-20 | 0.9519 | 0.9472 | 0.9424 |

| 2020-03-19 | 0.9256 | 0.9210 | 0.9164 |

| 2020-03-18 | 0.9209 | 0.9164 | 0.9118 |

| 2020-03-17 | 0.9564 | 0.9516 | 0.9469 |

| 2020-03-16 | 0.9301 | 0.9255 | 0.9208 |

| 2020-03-13 | 0.999 | 0.9941 | 0.9891 |

| 2020-03-12 | 0.979 | 0.9741 | 0.9693 |

| 2020-03-11 | 1.0339 | 1.0288 | 1.0236 |

| 2020-03-10 | 1.0616 | 1.0563 | 1.051 |

| 2020-03-09 | 1.044 | 1.0388 | 1.0336 |

| 2020-03-06 | 1.0957 | 1.0903 | 1.0848 |

| 2020-03-05 | 1.1147 | 1.1092 | 1.1036 |

| 2020-03-04 | 1.1182 | 1.1126 | 1.107 |

| 2020-03-03 | 1.1253 | 1.1197 | 1.1141 |

| 2020-03-02 | 1.135 | 1.1294 | 1.1237 |

| 2020-02-28 | 1.1294 | 1.1238 | 1.1182 |

| 2020-02-27 | 1.1304 | 1.1248 | 1.1192 |

| 2020-02-26 | 1.1607 | 1.1549 | 1.1491 |

| 2020-02-25 | 1.1582 | 1.1525 | 1.1467 |

| 2020-02-24 | 1.1747 | 1.1688 | 1.163 |

| 2020-02-21 | 1.208 | 1.2020 | 1.196 |

| 2020-02-20 | 1.2162 | 1.2102 | 1.2041 |

| 2020-02-19 | 1.213 | 1.2069 | 1.2009 |

| 2020-02-18 | 1.2099 | 1.2039 | 1.1978 |

| 2020-02-17 | 1.2119 | 1.2059 | 1.1998 |

| 2020-02-14 | 1.212 | 1.2059 | 1.1999 |

| 2020-02-13 | 1.2126 | 1.2066 | 1.2005 |

| 2020-02-12 | 1.2102 | 1.2042 | 1.1982 |

| 2020-02-11 | 1.213 | 1.2070 | 1.2009 |

| 2020-02-10 | 1.2116 | 1.2056 | 1.1996 |

| 2020-02-07 | 1.2168 | 1.2108 | 1.2047 |

| 2020-02-06 | 1.2148 | 1.2087 | 1.2027 |

| 2020-02-05 | 1.2054 | 1.1994 | 1.1934 |

| 2020-02-04 | 1.2026 | 1.1966 | 1.1906 |

| 2020-02-03 | 1.1953 | 1.1893 | 1.1834 |

| 2020-01-31 | 1.2039 | 1.1979 | 1.1919 |

| 2020-01-30 | 1.2014 | 1.1954 | 1.1894 |

| 2020-01-29 | 1.2017 | 1.1958 | 1.1898 |

| 2020-01-28 | 1.2009 | 1.1949 | 1.1889 |

| 2020-01-24 | 1.2079 | 1.2019 | 1.1959 |

| 2020-01-23 | 1.2056 | 1.1996 | 1.1936 |

| 2020-01-22 | 1.2141 | 1.2081 | 1.202 |

| 2020-01-21 | 1.2086 | 1.2026 | 1.1966 |

| 2020-01-20 | 1.2071 | 1.2011 | 1.1951 |

| 2020-01-17 | 1.2063 | 1.2003 | 1.1943 |

| 2020-01-16 | 1.2016 | 1.1957 | 1.1897 |

| 2020-01-15 | 1.1948 | 1.1888 | 1.1829 |

| 2020-01-14 | 1.1921 | 1.1861 | 1.1802 |

| 2020-01-13 | 1.1885 | 1.1826 | 1.1767 |

| 2020-01-10 | 1.1814 | 1.1755 | 1.1696 |

| 2020-01-09 | 1.1852 | 1.1793 | 1.1734 |

| 2020-01-08 | 1.1734 | 1.1676 | 1.1617 |

| 2020-01-07 | 1.1779 | 1.1721 | 1.1662 |

| 2020-01-06 | 1.1695 | 1.1637 | 1.1579 |

| 2020-01-03 | 1.1713 | 1.1655 | 1.1596 |

| 2020-01-02 | 1.1665 | 1.1607 | 1.1549 |

| 2019-12-31 | 1.1572 | 1.1515 | 1.1457 |

| 2019-12-30 | 1.1558 | 1.1500 | 1.1443 |

| 2019-12-27 | 1.1524 | 1.1466 | 1.1409 |

| 2019-12-24 | 1.1525 | 1.1468 | 1.141 |

| 2019-12-23 | 1.15 | 1.1443 | 1.1386 |

| 2019-12-20 | 1.1485 | 1.1427 | 1.137 |

| 2019-12-19 | 1.1515 | 1.1458 | 1.14 |

| 2019-12-18 | 1.1556 | 1.1499 | 1.1441 |

| 2019-12-17 | 1.1573 | 1.1515 | 1.1457 |

| 2019-12-16 | 1.1497 | 1.1440 | 1.1383 |

| 2019-12-13 | 1.1489 | 1.1432 | 1.1375 |

| 2019-12-12 | 1.1368 | 1.1311 | 1.1255 |

| 2019-12-11 | 1.1397 | 1.1341 | 1.1284 |

| 2019-12-10 | 1.1449 | 1.1392 | 1.1335 |

| 2019-12-09 | 1.1234 | 1.1178 | 1.1122 |

| 2019-12-06 | 1.1249 | 1.1193 | 1.1137 |

| 2019-12-05 | 1.1193 | 1.1137 | 1.1082 |

| 2019-12-04 | 1.1122 | 1.1066 | 1.1011 |

| 2019-12-03 | 1.1066 | 1.1011 | 1.0956 |

| 2019-12-02 | 1.1171 | 1.1115 | 1.1059 |

| 2019-11-29 | 1.1268 | 1.1211 | 1.1155 |

| 2019-11-28 | 1.1238 | 1.1182 | 1.1126 |

| 2019-11-27 | 1.1215 | 1.1160 | 1.1104 |

| 2019-11-26 | 1.1204 | 1.1148 | 1.1092 |

| 2019-11-25 | 1.121 | 1.1154 | 1.1098 |

| 2019-11-22 | 1.1124 | 1.1068 | 1.1013 |

| 2019-11-21 | 1.1044 | 1.0989 | 1.0934 |

| 2019-11-20 | 1.1037 | 1.0982 | 1.0927 |

| 2019-11-19 | 1.1047 | 1.0992 | 1.0937 |

| 2019-11-18 | 1.1072 | 1.1017 | 1.0962 |

| 2019-11-15 | 1.1035 | 1.0980 | 1.0925 |

| 2019-11-14 | 1.1063 | 1.1008 | 1.0953 |

| 2019-11-13 | 1.0988 | 1.0934 | 1.0879 |

| 2019-11-12 | 1.0951 | 1.0897 | 1.0842 |

| 2019-11-11 | 1.0927 | 1.0873 | 1.0819 |

| 2019-11-08 | 1.0833 | 1.0779 | 1.0725 |

| 2019-11-07 | 1.0805 | 1.0751 | 1.0697 |

| 2019-11-06 | 1.0739 | 1.0685 | 1.0632 |

| 2019-11-05 | 1.0706 | 1.0653 | 1.06 |

| 2019-11-04 | 1.072 | 1.0667 | 1.0614 |

| 2019-11-01 | 1.0644 | 1.0591 | 1.0538 |

| 2019-10-31 | 1.0659 | 1.0606 | 1.0553 |

| 2019-10-30 | 1.0616 | 1.0563 | 1.0511 |

| 2019-10-29 | 1.0608 | 1.0555 | 1.0502 |

| 2019-10-28 | 1.0615 | 1.0563 | 1.051 |

| 2019-10-25 | 1.0602 | 1.0549 | 1.0497 |

| 2019-10-24 | 1.0554 | 1.0502 | 1.0449 |

| 2019-10-23 | 1.0498 | 1.0446 | 1.0394 |

| 2019-10-22 | 1.0478 | 1.0426 | 1.0374 |

| 2019-10-21 | 1.0481 | 1.0429 | 1.0377 |

| 2019-10-18 | 1.0403 | 1.0351 | 1.0299 |

| 2019-10-17 | 1.0423 | 1.0371 | 1.0319 |

| 2019-10-16 | 1.0477 | 1.0425 | 1.0373 |

| 2019-10-15 | 1.0424 | 1.0372 | 1.032 |

| 2019-10-14 | 1.0368 | 1.0316 | 1.0265 |

| 2019-10-11 | 1.0365 | 1.0313 | 1.0262 |

| 2019-10-10 | 1.0289 | 1.0238 | 1.0187 |

| 2019-10-09 | 1.0274 | 1.0223 | 1.0172 |

| 2019-10-08 | 1.0265 | 1.0214 | 1.0163 |

| 2019-10-04 | 1.0286 | 1.0234 | 1.0183 |

| 2019-10-03 | 1.0282 | 1.0231 | 1.0179 |

| 2019-10-02 | 1.0351 | 1.0300 | 1.0248 |

| 2019-10-01 | 1.0411 | 1.0360 | 1.0308 |

| 2019-09-30 | 1.0373 | 1.0321 | 1.027 |

| 2019-09-27 | 1.0337 | 1.0285 | 1.0234 |

| 2019-09-26 | 1.0321 | 1.0270 | 1.0218 |

| 2019-09-25 | 1.0306 | 1.0255 | 1.0204 |

| 2019-09-24 | 1.0324 | 1.0272 | 1.0221 |

| 2019-09-23 | 1.0369 | 1.0317 | 1.0265 |

| 2019-09-20 | 1.0394 | 1.0342 | 1.0291 |

| 2019-09-19 | 1.038 | 1.0328 | 1.0277 |

| 2019-09-18 | 1.0285 | 1.0234 | 1.0183 |

| 2019-09-17 | 1.0298 | 1.0246 | 1.0195 |

| 2019-09-16 | 1.0288 | 1.0237 | 1.0186 |

| 2019-09-13 | 1.0264 | 1.0213 | 1.0162 |

| 2019-09-12 | 1.0211 | 1.0160 | 1.0109 |

| 2019-09-11 | 1.0268 | 1.0217 | 1.0166 |

| 2019-09-10 | 1.0228 | 1.0177 | 1.0126 |

| 2019-09-09 | 1.0168 | 1.0117 | 1.0066 |

| 2019-09-06 | 1.0196 | 1.0146 | 1.0095 |

| 2019-09-05 | 1.0286 | 1.0235 | 1.0184 |

| 2019-09-04 | 1.0233 | 1.0182 | 1.0131 |

| 2019-09-03 | 1.0264 | 1.0213 | 1.0162 |

| 2019-09-02 | 1.0298 | 1.0247 | 1.0195 |

| 2019-08-30 | 1.0282 | 1.0231 | 1.018 |

| 2019-08-29 | 1.0191 | 1.0141 | 1.009 |

| 2019-08-28 | 1.0183 | 1.0133 | 1.0082 |

| 2019-08-27 | 1.0171 | 1.0120 | 1.0069 |

| 2019-08-26 | 1.0084 | 1.0033 | 0.9983 |

| 2019-08-23 | 1.0157 | 1.0107 | 1.0056 |

| 2019-08-22 | 1.024 | 1.0189 | 1.0138 |

| 2019-08-21 | 1.0203 | 1.0152 | 1.0101 |

| 2019-08-20 | 1.017 | 1.0120 | 1.0069 |

| 2019-08-19 | 1.0167 | 1.0116 | 1.0065 |

| 2019-08-16 | 1.0022 | 0.9972 | 0.9923 |

| 2019-08-15 | 0.993 | 0.9881 | 0.9831 |

| 2019-08-14 | 1.0086 | 1.0036 | 0.9986 |

| 2019-08-13 | 1.014 | 1.0090 | 1.0039 |

| 2019-08-12 | 1.0215 | 1.0164 | 1.0113 |

| 2019-08-09 | 1.0177 | 1.0126 | 1.0075 |

| 2019-08-08 | 1.017 | 1.0119 | 1.0069 |

| 2019-08-07 | 1.0146 | 1.0095 | 1.0045 |

| 2019-08-06 | 1.0059 | 1.0009 | 0.9959 |

| 2019-08-05 | 1.0126 | 1.0075 | 1.0025 |

| 2019-08-02 | 1.0282 | 1.0231 | 1.018 |

| 2019-08-01 | 1.0265 | 1.0214 | 1.0163 |

| 2019-07-31 | 1.0328 | 1.0276 | 1.0225 |

| 2019-07-30 | 1.0362 | 1.0310 | 1.0259 |

| 2019-07-29 | 1.0332 | 1.0281 | 1.023 |

| 2019-07-26 | 1.0306 | 1.0254 | 1.0203 |

| 2019-07-25 | 1.0245 | 1.0194 | 1.0143 |

| 2019-07-24 | 1.0206 | 1.0155 | 1.0104 |

| 2019-07-23 | 1.0151 | 1.0101 | 1.005 |

| 2019-07-22 | 1.0113 | 1.0063 | 1.0013 |

| 2019-07-19 | 1.0123 | 1.0073 | 1.0022 |

| 2019-07-18 | 1.0145 | 1.0095 | 1.0044 |

| 2019-07-17 | 1.0235 | 1.0184 | 1.0133 |

| 2019-07-16 | 1.0236 | 1.0185 | 1.0134 |

| 2019-07-15 | 1.029 | 1.0239 | 1.0188 |

| 2019-07-12 | 1.0367 | 1.0315 | 1.0264 |

| 2019-07-11 | 1.0404 | 1.0352 | 1.0301 |

| 2019-07-10 | 1.044 | 1.0388 | 1.0336 |

| 2019-07-09 | 1.049 | 1.0438 | 1.0385 |

| 2019-07-08 | 1.0484 | 1.0432 | 1.0379 |

| 2019-07-05 | 1.0545 | 1.0492 | 1.044 |

| 2019-07-04 | 1.0515 | 1.0463 | 1.041 |

| 2019-07-03 | 1.0493 | 1.0440 | 1.0388 |

| 2019-07-02 | 1.0566 | 1.0514 | 1.0461 |

| 2019-07-01 | 1.0579 | 1.0527 | 1.0474 |

| 2019-06-28 | 1.0695 | 1.0642 | 1.0589 |

| 2019-06-27 | 1.0679 | 1.0626 | 1.0572 |

| 2019-06-26 | 1.0637 | 1.0584 | 1.0531 |

| 2019-06-25 | 1.0649 | 1.0596 | 1.0543 |

| 2019-06-24 | 1.0737 | 1.0683 | 1.063 |

| 2019-06-21 | 1.0812 | 1.0758 | 1.0704 |

| 2019-06-20 | 1.0839 | 1.0785 | 1.0732 |

| 2019-06-19 | 1.0842 | 1.0788 | 1.0734 |

| 2019-06-18 | 1.0761 | 1.0708 | 1.0654 |

| 2019-06-17 | 1.0754 | 1.0701 | 1.0647 |

| 2019-06-14 | 1.0748 | 1.0695 | 1.0641 |

| 2019-06-13 | 1.0705 | 1.0652 | 1.0599 |

| 2019-06-12 | 1.0678 | 1.0625 | 1.0572 |

| 2019-06-11 | 1.0657 | 1.0604 | 1.0551 |

| 2019-06-07 | 1.0449 | 1.0397 | 1.0345 |

| 2019-06-06 | 1.0444 | 1.0392 | 1.034 |

| 2019-06-05 | 1.0462 | 1.0410 | 1.0358 |

| 2019-06-04 | 1.0414 | 1.0362 | 1.031 |

| 2019-06-03 | 1.0381 | 1.0329 | 1.0278 |

| 2019-05-31 | 1.0457 | 1.0405 | 1.0353 |

| 2019-05-30 | 1.0527 | 1.0474 | 1.0422 |

| 2019-05-29 | 1.0531 | 1.0479 | 1.0427 |

| 2019-05-28 | 1.0609 | 1.0556 | 1.0504 |

| 2019-05-27 | 1.0619 | 1.0566 | 1.0513 |

| 2019-05-24 | 1.0611 | 1.0558 | 1.0505 |

| 2019-05-23 | 1.0631 | 1.0578 | 1.0525 |

| 2019-05-22 | 1.0715 | 1.0662 | 1.0609 |

| 2019-05-21 | 1.0703 | 1.0650 | 1.0597 |

| 2019-05-20 | 1.0596 | 1.0543 | 1.049 |

| 2019-05-17 | 1.0648 | 1.0595 | 1.0542 |

| 2019-05-16 | 1.059 | 1.0537 | 1.0484 |

| 2019-05-15 | 1.0561 | 1.0508 | 1.0456 |

| 2019-05-14 | 1.0566 | 1.0514 | 1.0461 |

| 2019-05-13 | 1.0546 | 1.0493 | 1.0441 |

| 2019-05-10 | 1.0587 | 1.0534 | 1.0481 |

| 2019-05-09 | 1.057 | 1.0517 | 1.0464 |

| 2019-05-08 | 1.0521 | 1.0469 | 1.0416 |

| 2019-05-07 | 1.0533 | 1.0480 | 1.0428 |

| 2019-05-06 | 1.0589 | 1.0536 | 1.0484 |

| 2019-05-03 | 1.0639 | 1.0586 | 1.0533 |

| 2019-05-02 | 1.0577 | 1.0525 | 1.0472 |

| 2019-05-01 | 1.059 | 1.0537 | 1.0485 |

| 2019-04-30 | 1.0554 | 1.0501 | 1.0448 |

| 2019-04-29 | 1.0533 | 1.0480 | 1.0428 |

| 2019-04-26 | 1.0522 | 1.0470 | 1.0417 |

| 2019-04-24 | 1.0519 | 1.0466 | 1.0414 |

| 2019-04-23 | 1.0437 | 1.0385 | 1.0333 |

| 2019-04-18 | 1.0314 | 1.0262 | 1.0211 |

| 2019-04-17 | 1.0332 | 1.0281 | 1.023 |

| 2019-04-16 | 1.0346 | 1.0295 | 1.0243 |

| 2019-04-15 | 1.0335 | 1.0283 | 1.0232 |

| 2019-04-12 | 1.0317 | 1.0266 | 1.0215 |

| 2019-04-11 | 1.0303 | 1.0252 | 1.0201 |

| 2019-04-10 | 1.0255 | 1.0204 | 1.0153 |

| 2019-04-09 | 1.0248 | 1.0197 | 1.0146 |

| 2019-04-08 | 1.0284 | 1.0233 | 1.0182 |

| 2019-04-05 | 1.026 | 1.0209 | 1.0158 |

| 2019-04-04 | 1.0227 | 1.0176 | 1.0125 |

| 2019-04-03 | 1.019 | 1.0140 | 1.0089 |

| 2019-04-02 | 1.0198 | 1.0147 | 1.0097 |

| 2019-04-01 | 1.0139 | 1.0089 | 1.0038 |

| 2019-03-29 | 1.006 | 1.0010 | 0.996 |

| 2019-03-28 | 1.0069 | 1.0019 | 0.9969 |

| 2019-03-27 | 1.0096 | 1.0046 | 0.9996 |

| 2019-03-26 | 1.0057 | 1.0007 | 0.9957 |

| 2019-03-25 | 1.0036 | 0.9986 | 0.9937 |

| 2019-03-22 | 1.0134 | 1.0084 | 1.0033 |

| 2019-03-21 | 1.0169 | 1.0119 | 1.0068 |

| 2019-03-20 | 1.0213 | 1.0162 | 1.0112 |

| 2019-03-19 | 1.0309 | 1.0258 | 1.0206 |

| 2019-03-18 | 1.0278 | 1.0227 | 1.0176 |

| 2019-03-15 | 1.0246 | 1.0195 | 1.0144 |

| 2019-03-14 | 1.0174 | 1.0123 | 1.0073 |

| 2019-03-13 | 1.0165 | 1.0114 | 1.0064 |

| 2019-03-12 | 1.0072 | 1.0022 | 0.9971 |

| 2019-03-11 | 1.0023 | 0.9973 | 0.9923 |

| 2019-03-08 | 0.9925 | 0.9875 | 0.9826 |

| 2019-03-07 | 1.0039 | 0.9989 | 0.9939 |

| 2019-03-06 | 1.0126 | 1.0076 | 1.0025 |

| 2019-03-05 | 1.008 | 1.0029 | 0.9979 |

| 2019-03-04 | 1.0072 | 1.0021 | 0.9971 |

| 2019-03-01 | 1 | 1.0000 | 1 |

Unit prices are net of fees & do not include distributions. Past performance is not a reliable indicator of future performance.

Distribution History

| Ex Date | Net Entry Price | NAV | Net Exit Price | Ex Entry Price | Ex NAV | Ex Exit Price | Cash Portion | Franking Credits |

|---|---|---|---|---|---|---|---|---|

| 28/06/2024 | 1.4585 | 1.4541 | 1.4497 | 1.4324 | 1.4281 | 1.4238 | 2.6004 | 0.02311032 |

| 30/06/2023 | 1.3745 | 1.3704 | 1.3663 | 1.3671 | 1.3630 | 1.3589 | 0.7369 | |

| 30/06/2022 | 1.1312 | 1.1256 | 1.1200 | 1.1264 | 1.1208 | 1.1152 | 0.4827 | 0.0056 |

| 30/06/2021 | 1.6067 | 1.5987 | 1.5907 | 1.3982 | 1.3912 | 1.3842 | 20.7454 | 0.0011 |

| 30/06/2020 | 1.1502 | 1.1445 | 1.1388 | 1.1066 | 1.1011 | 1.0956 | 4.3374 | 0.0013 |

| 28/06/2019 | 1.0695 | 1.0642 | 1.0589 | 1.0510 | 1.0458 | 1.0405 | 1.8446 | 0.0004 |

Updates and Reports

Invest Now

Platform Availability List

The Spheria Global Opportunities Fund is available on the below Platforms. Platforms provide investors with consolidated and centralised reporting (including administration, tax, and distribution) by bundling together a range of managed funds as one single product. If the Fund is not available on your preferred platform, please contact us. Please check with your platform for minimum investment requirements and fees.

Asgard

BT Panorama

HUB24

Macquarie Wrap

Netwealth

Praemium

Apply online

Complete and submit an application in a quarter of the time it takes to invest via paper based application. Investors with a verified account can top-up investments or invest in other funds in a fraction of the time.

Paper Forms

Need assistance?

Call 1300 010 311 | Email: service@pinnacleinvestment.com

Disclaimer

This webpage is prepared by Spheria Asset Management Pty Limited (‘Spheria’) (ABN 42 611 081 326, Corporate Authorised Representative No. 1240979) of Pinnacle Investment Management Limited (‘PIML’) (ABN 66 109 659 109, AFSL 322140) as the investment manager of the Spheria Global Opportunities Fund (ARSN 627 330 287) (the ‘Fund’). Pinnacle Fund Services Limited (‘PFSL’) (ABN 29 082 494 362, AFSL 238371) is the product issuer of the Fund. PFSL is not licensed to provide financial product advice. PFSL is a wholly-owned subsidiary of the Pinnacle Investment Management Group Limited (‘Pinnacle’) (ABN 22 100 325 184).

The information provided in this website is of a general nature only and has been prepared without taking into account your objectives, financial situation or needs. Before making an investment decision in respect of the Fund, you should consider the current Product Disclosure Statement (PDS) and Target Market Determination (‘TMD’) of the Fund and the Fund’s other periodic and continuous disclosure announcements lodged with the ASX, which are available at www.asx.com.au, and assess whether the Fund is appropriate given your objectives, financial situation or needs. If you require advice that takes into account your personal circumstances, you should consult a licensed or authorised financial adviser.

Neither PFSL nor Spheria guarantees repayment of capital or any particular rate of return from the Fund. There can be no assurance that the Fund will achieve its investment objectives. The value of your units at any point in time may be worth less than your original investment even after taking into account the reinvestment of Fund distributions. Returns are not guaranteed, and you may lose some or all of your money. The specific risks associated with investing in the Fund, and the risks associated with the Fund’s investments, are discussed in Section 3 of the Product Disclosure Statement. Neither PFSL nor Spheria gives any representation or warranty as to the currency, reliability, completeness or accuracy of the information contained in this website. All opinions and estimates included in this website constitute judgments of Spheria as at the date of website creation and are subject to change without notice. Past performance is not a reliable indicator of future performance.

1 The Zenith Investment Partners (‘Zenith’) (ABN 27 103 132 672, AFSL 226872) rating (assigned Spheria Global Opportunities Fund – November 2022) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at Fund Research Regulatory Guidelines.

2 The rating issued (Spheria Global Opportunities fund WHT6704AU rating issued March 2023) is published by Lonsec Research Pty Ltd (‘Lonsec’) (ABN 11 151 658 561, AFSL 421 445). Ratings are general advice only, and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec assumes no obligation to update. Lonsec uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2022 Lonsec. All rights reserved.